Avon 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

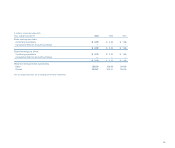

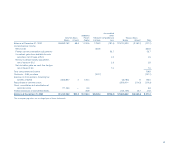

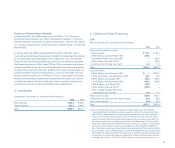

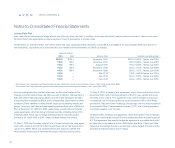

For each of the three years ended December 31, the components of basic

and diluted earnings per share were as follows:

2003 2002 2001

Numerator:

Basic:

Income from continuing

operations before cumulative

effect of accounting change $664.8 $534.6 $444.9

Cumulative effect of accounting change — — (.3)

Net income $664.8 $534.6 $444.6

Diluted:

Income from continuing operations before

cumulative effect of accounting change $664.8 $534.6 $444.9

Interest expense on Convertible Notes,

net of taxes 5.7 10.4 10.0

Income for purposes of computing diluted

EPS before cumulative effect of

accounting change 670.5 545.0 454.9

Cumulative effect of accounting change — — (.3)

Net income for purposes of computing

diluted EPS $670.5 $545.0 $454.6

Denominator:

Basic EPS weighted-average

shares outstanding 235.54 236.06 236.83

Dilutive effect of:

Assumed conversion of stock options

and settlement of forward contracts 2.37 2.45* 2.26*

Assumed conversion of Convertible Notes 3.66 6.96 6.96

Diluted EPS adjusted weighted-average

shares outstanding 241.57 245.47 246.05

Basic EPS:

Continuing operations $ 2.82 $ 2.26 $ 1.88

Cumulative effect of accounting changes — — —

$ 2.82 $ 2.26 $ 1.88

Diluted EPS:

Continuing operations $ 2.78 $ 2.22 $ 1.85

Cumulative effect of accounting changes — — —

$ 2.78 $ 2.22 $ 1.85

* At December 31, 2002 and 2001, stock options and forward contracts to purchase Avon

common stock totaling 2.8 million shares and .3 million shares, respectively, are not

included in the diluted EPS calculation since their impact is anti-dilutive.

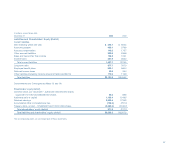

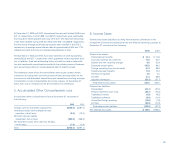

2. Accounting Changes

Accounting for Certain Sales Incentives

Effective January 1, 2002, Avon adopted Emerging Issues Task Force (“EITF”)

No. 00-14, “Accounting for Certain Sales Incentives,” which requires the cost

of certain products and cash incentives used in Avon’s promotional activities,

previously reported in Marketing, distribution and administrative expenses, to

be classified as Cost of sales or as a reduction of Net sales.

Effective January 1, 2002, Avon adopted EITF No. 00-25, “Accounting for

Consideration from a Vendor to a Retailer in Connection with the Purchase

or Promotion of the Vendor’s Products” and EITF No. 01-09, “Accounting for

Consideration Given by a Vendor to a Customer (Including a Reseller of the

Vendor’s Products),” which require certain expenses related to the U.S.

Retail business previously included in Marketing, distribution and adminis-

trative expenses to be classified as a reduction of Net sales.

Accounting for Goodwill and Other Intangibles Assets

Effective January 1, 2002, Avon adopted FAS No. 142, “Goodwill and Other

Intangible Assets.” Under FAS No. 142, goodwill and intangible assets with

indefinite lives are no longer amortized, but are assessed for impairment annu-

ally and upon the occurrence of an event that indicates impairment may have

occurred. In accordance with FAS No. 142, Avon completed its annual goodwill

impairment assessment based on an evaluation of estimated future cash flow

and no adjustments to goodwill were necessary in 2003 and 2002. Goodwill

totaled $45.2 and $25.4 at December 31, 2003 and 2002, respectively. Intangible

assets totaled $1.0 and $.6 at December 31, 2003 and 2002, respectively.

The pro forma effect of FAS No. 142 assuming Avon had adopted this stan-

dard on January 1, 2001, was not material to Avon’s Income from continuing

operations before cumulative effect of accounting change, Net income or

Basic and Diluted earnings per share for the year ended December 31, 2001.

Advertising costs totaled $111.6 million in 2003, up 11% from

2002’s advertising spend. R&D costs in 2003 were $49.6 million,

an increase of 4% from 2002’s level.

65