Avon 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

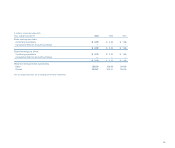

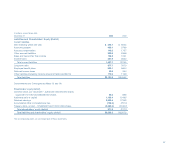

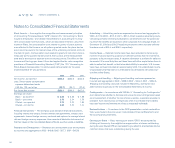

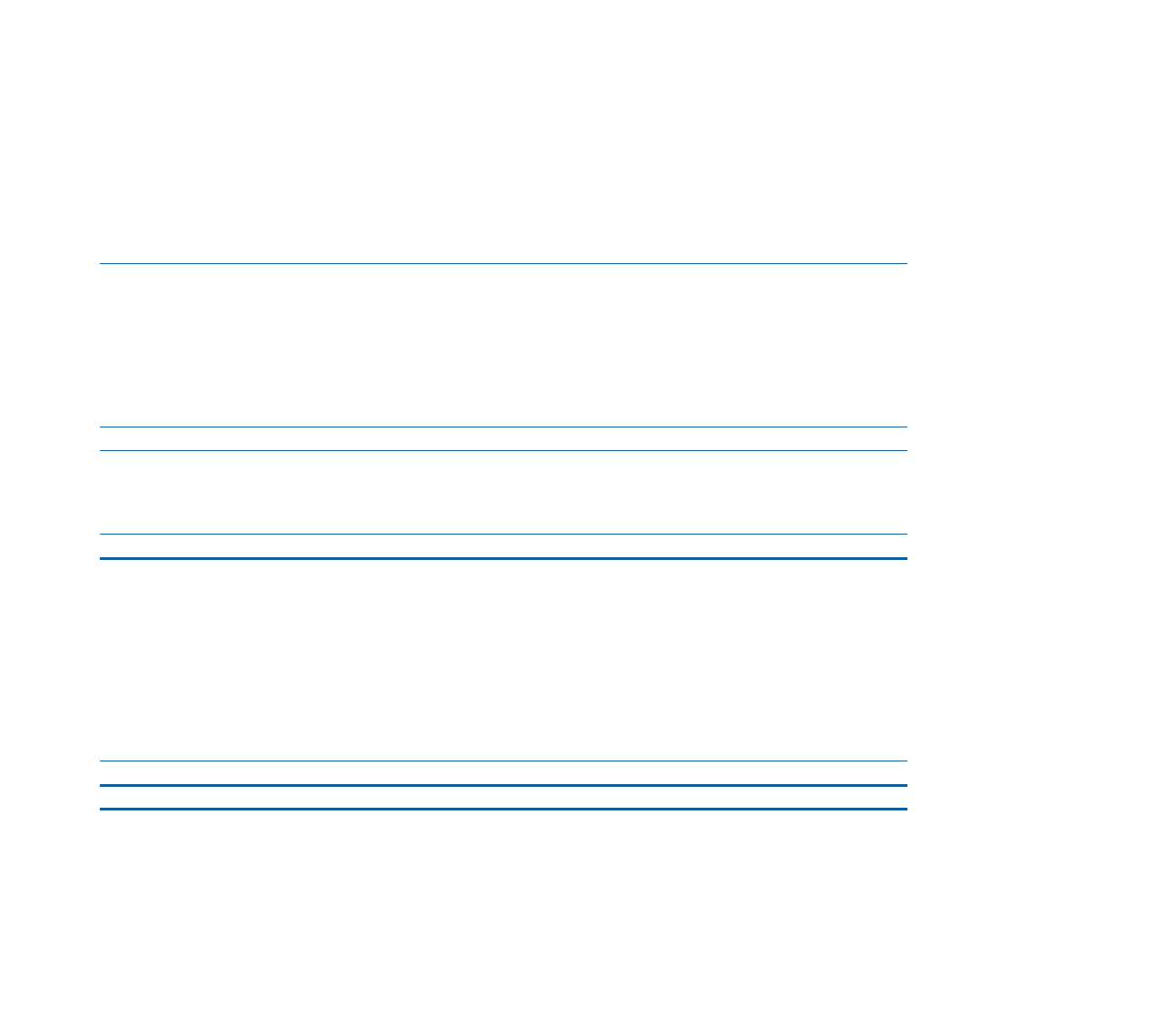

In millions, except share data

December 31 2003 2002

Liabilities and Shareholders’ Equity (Deficit)

Current liabilities

Debt maturing within one year $ 244.1 $ 605.2

Accounts payable 400.1 379.9

Accrued compensation 149.5 175.7

Other accrued liabilities 332.6 336.6

Sales and taxes other than income 139.5 125.1

Income taxes 321.9 353.0

Total current liabilities 1,587.7 1,975.5

Long-term debt 877.7 767.0

Employee benefit plans 502.1 560.4

Deferred income taxes 50.6 35.4

Other liabilities (including minority interest of $46.0 and $37.0) 172.9 116.9

Total liabilities $3,191.0 $3,455.2

Commitments and Contingencies (Notes 12 and 14)

Shareholders’ equity (deficit)

Common stock, par value $.25 – authorized: 800,000,000 shares;

issued 361,127,052 and 358,382,162 shares 90.3 89.6

Additional paid-in capital 1,188.4 1,019.5

Retained earnings 2,202.4 1,735.3

Accumulated other comprehensive loss (729.4) (791.4)

Treasury stock, at cost – 125,828,622 and 123,124,530 shares (2,380.4) (2,180.7)

Total shareholders’ equity (deficit) 371.3 (127.7)

Total liabilities and shareholders’ equity (deficit) $3,562.3 $3,327.5

The accompanying notes are an integral part of these statements.

57