Avon 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

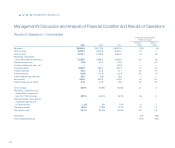

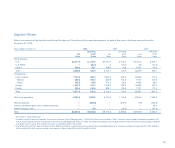

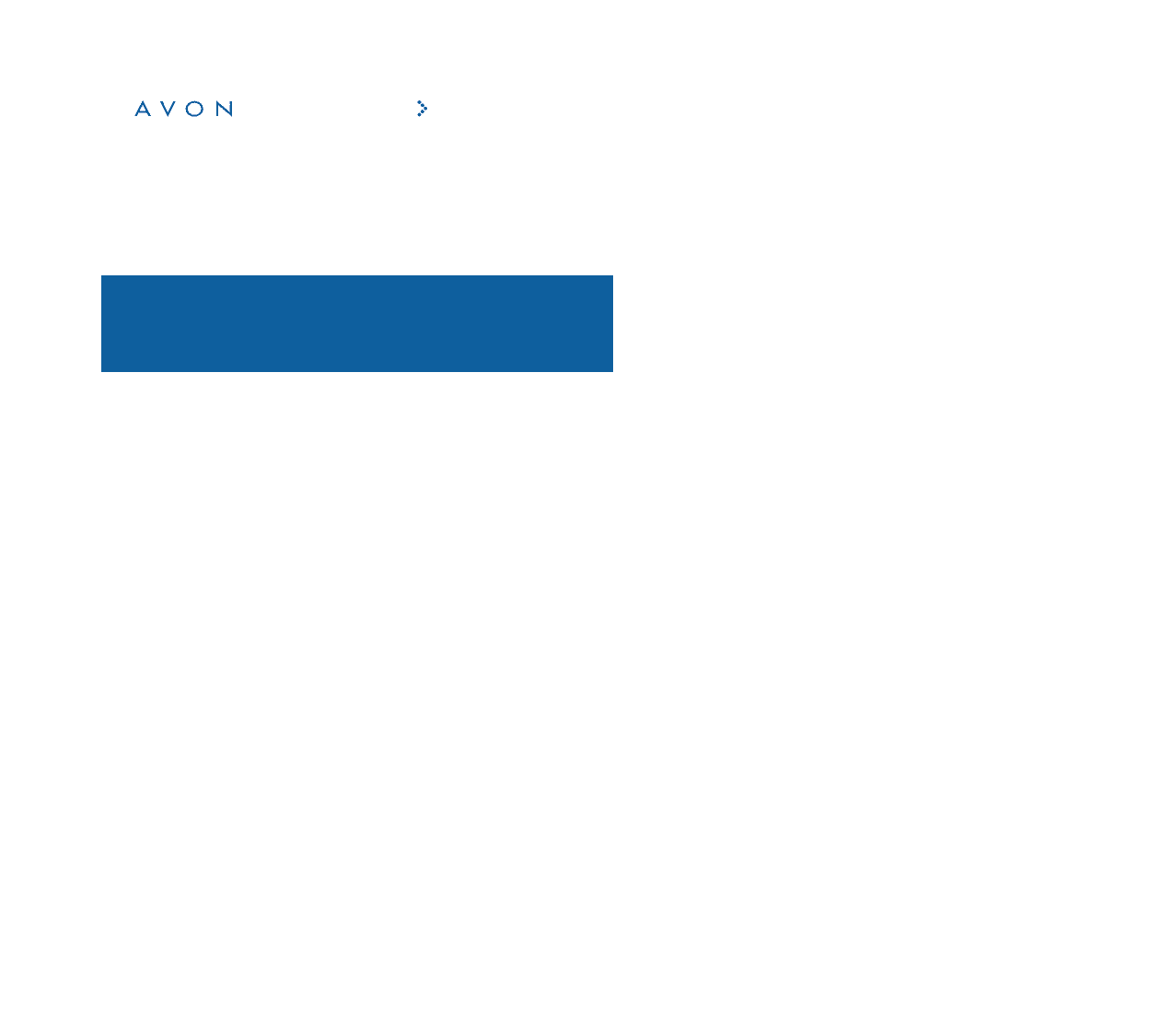

Segment Review – 2003 Compared to 2002

Latin America

%/Point Change

Local

2003 2002 US $ Currency

Net sales $1,747.2 $1,654.9 6% 15%

Operating profit 406.3 361.6 12 21

Operating margin 23.2% 21.8% 1.4 1.4

Units sold 2%

Active Representatives 12%

Net sales increased in U.S. dollars and local currencies in 2003 most signifi-

cantly in the following markets:

• In Argentina, Net sales in U.S. dollars and local currency increased sub-

stantially, primarily driven by significant growth in active Representatives

and successful new product launches.

• In Brazil, Net sales in U.S. dollars and local currency increased, reflecting

growth in active Representatives and a shift in product mix towards

higher priced products. Although local currency sales increased, units

declined due to the shift in product mix towards higher priced products.

• In Mexico, Net sales increased in U.S. dollars and local currency,

benefiting from growth in active Representatives, and new product

launches, as well as sales promotion offers which drove unit growth

in this market.

• In Venezuela, Net sales increased in U.S. dollars and local currency

driven by growth in active Representatives and units, and Avon’s ability

to provide good service to its Representatives despite external factors

such as the national strike that lasted until February 2003 and the

exchange rate control imposed by the Venezuelan government in

February 2003.

The increase in operating margin in Latin America in 2003 was most signifi-

cantly impacted by the following markets:

• In Mexico, operating margin increased (which increased segment margin

by 1.3 points) due to a lower expense ratio, reflecting savings associated

with Business Transformation initiatives, including a gain from the sale of

property in Mexico City, as the Company transitioned to a new distribu-

tion center in Celaya, partially offset by an increase in consumer and

strategic investments such as spending on advertising and the brochure.

Operating margin also benefited from an improvement in gross margin

resulting from the introduction of products with higher margins, a favor-

able mix of products sold, and supply chain savings associated with

Business Transformation initiatives.

• In Argentina, operating margin increased (which increased segment

margin by .5 point) primarily due to an improvement in the expense ratio

driven by a significant increase in local currency sales and lower logisti-

cal costs. Additionally, gross margin improved due to pricing strategies

and savings associated with supply chain Business Transformation ini-

tiatives.

• In Venezuela, operating margin increased (which increased segment

margin by .1 point) due to an increase in gross margin resulting from

pricing strategies, a favorable mix of products sold and supply chain

savings related to Business Transformation initiatives.

• In Brazil, operating margin decreased (which decreased segment mar-

gin by .5 point) primarily due to an increase in the expense ratio result-

ing from overhead under absorption due to a unit shortfall, which more

than offset the growth in gross margin resulting from the sale of higher

priced Beauty products.

36