Avon 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

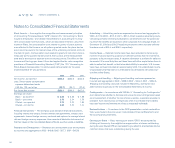

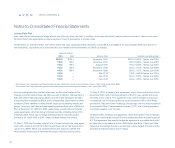

Stock Awards — Avon applies the recognition and measurement principles

of Accounting Principles Board (“APB”) Opinion 25, “Accounting for Stock

Issued to Employees,” and related interpretations in accounting for its long-

term stock-based incentive plans, which are described in Note 8, Long-Term

Incentive Plans. No compensation cost related to grants of stock options

was reflected in Net income, as all options granted under the plans had an

exercise price equal to the market value of the underlying common stock on

the date of grant. Compensation cost related to grants of restricted stock is

measured as the quoted market price of Avon’s stock at the measurement

date and is amortized to expense over the vesting period. The effect on Net

income and Earnings per share if Avon had applied the fair value recognition

provisions of Financial Accounting Standard (“FAS”) No. 123, “Accounting for

Stock-Based Compensation,” to stock-based compensation for the years

ended December 31 was as follows:

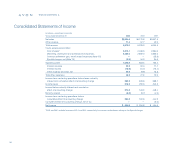

2003 2002 2001

Net income, as reported $664.8 $534.6 $444.6

Less: Stock-based compensation

expense determined under

FAS No. 123, net of tax (28.7) (30.1) (27.6)

Pro forma Net income $636.1 $504.5 $417.0

Earnings per share:

Basic – as reported $ 2.82 $ 2.26 $ 1.88

Basic – pro forma 2.70 2.14 1.76

Diluted – as reported 2.78 2.22 1.85

Diluted – pro forma 2.66 2.10 1.74

Financial Instruments — The Company uses derivative financial instruments,

including interest rate swaps, forward interest rate agreements, treasury lock

agreements, forward foreign currency contracts and options, to manage interest

rate and foreign currency exposures. Avon records all derivative instruments at

their fair values on the Consolidated Balance Sheets as either assets or liabilities.

Research and Development — Research and development costs are expensed

as incurred and aggregated in 2003 – $49.6 (2002 - $47.7; 2001 – $45.9).

Advertising — Advertising costs are expensed as incurred and aggregated in

2003 – $111.6 (2002 – $101.0; 2001 – $97.2). Direct response advertising costs,

consisting primarily of brochure preparation, are amortized over the period dur-

ing which the benefits are expected, which is typically the campaign length. At

December 31, 2003 and 2002, Prepaid expenses and other included deferred

brochure costs of $34.4 and $25.0, respectively.

Income Taxes — Deferred income taxes have been provided on items recog-

nized for financial reporting purposes in different periods than for income tax

purposes at future enacted rates. A valuation allowance is provided for deferred

tax assets if it is more likely than not these items will either expire before Avon is

able to realize their benefit, or that future deductibility is uncertain. U.S. income

taxes have not been provided on approximately $423.1 of undistributed income

of subsidiaries that has been or is intended to be permanently reinvested out-

side the United States.

Shipping and Handling — Shipping and handling costs are expensed as

incurred and aggregated in 2003 – $599.0 (2002 – $544.0; 2001 – $534.0).

Shipping and handling costs are included in Marketing, distribution and

administrative expenses on the Consolidated Statements of Income.

Contingencies — In accordance with FAS No. 5, “Accounting for Contingencies,”

Avon determines whether to disclose and accrue for loss contingencies based

on an assessment of whether the risk of loss is remote, reasonably possible or

probable. Avon records loss contingencies when it is probable that a liability

has been incurred and the amount of loss is reasonably estimable.

Reclassifications — To conform to the 2003 presentation, certain reclassifica-

tions were made to the prior years’ Consolidated Financial Statements and

the accompanying footnotes.

Earnings per Share — Basic earnings per share (“EPS”) are computed by

dividing net income by the weighted-average number of shares outstanding

during the year. Diluted EPS are calculated to give effect to all potentially dilutive

common shares that were outstanding during the year.

Notes to Consolidated Financial Statements

notes to statements

64