Avon 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

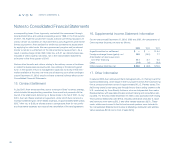

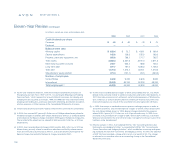

14. Contingencies

Avon is a defendant in a class action suit commenced in 1991 on behalf of

certain classes of holders of Avon’s Preferred Equity-Redemption Cumulative

Stock (“PERCS”). Plaintiffs allege various contract and securities law claims

related to the PERCS (which were fully redeemed in 1991) and seek aggregate

damages of approximately $145.0, plus interest. A trial of this action took place

in the United States District Court for the Southern District of New York and

concluded in November 2001. At the conclusion of the trial, the judge reserved

decision in the matter. Avon believes it presented meritorious defenses to the

claims asserted. However, it is not possible to predict the outcome of litigation

and it is reasonably possible that the trial, and any possible appeal, could be

decided unfavorably. Management is unable to make a meaningful estimate of

the amount or range of loss that could result from an unfavorable outcome but,

under some of the damage theories presented, an adverse award could be

material to the Consolidated Financial Statements.

Avon is a defendant in an action commenced in the Supreme Court of the State

of New York by Sheldon Solow d/b/a Solow Building Company, the landlord of

the Company’s former headquarters in New York City. Plaintiff seeks aggregate

damages of approximately $80.0, plus interest, for the Company’s alleged fail-

ure to restore the leasehold premises at the conclusion of the lease term in 1997.

A trial of this matter was scheduled for February 2002, but was stayed pending

the determination of (i) an interlocutory appeal by plaintiff of an order that denied

the plaintiff’s motion for summary judgment and granted partial summary judg-

ment in favor of the Company on one of the plaintiff’s claims; and (ii) an appeal by

plaintiff of a decision in an action against another former tenant that dismissed

plaintiff’s claims after trial. In January 2003, both appeals were decided against

the plaintiff. Plaintiff filed motions for leave to appeal both decisions, which were

denied. A trial has been scheduled to commence on May 24, 2004. In a separate

action that has been pending since 1975, Solow alleges that Avon misappropri-

ated the name of its former headquarters building and seeks damages based on

a purported value of one dollar per square foot of leased space over the term of

the lease. Although this action remained dormant for over twenty years, discovery

in the matter has been revived. While it is not possible to predict the outcome of

litigation, management believes that there are meritorious defenses to the claims

asserted and that these actions should not have a material adverse effect on the

Consolidated Financial Statements. These actions are being vigorously contested.

Avon Products Foundation, Inc. (the “Avon Foundation”) is a defendant in

an arbitration proceeding brought by Pallotta TeamWorks (“Pallotta”) on

September 3, 2002, before Judicial Arbitration and Mediation Services, Inc.

Pallotta asserts claims of breach of contract, misappropriation of opportunity,

tortious interference with prospective contractual arrangement and unfair com-

petition arising out of the Avon Foundation’s decision to use another party to

conduct breast cancer fundraising events, and seeks unspecified damages

and attorneys’ fees. The arbitrator dismissed Pallotta’s misappropriation claim

in January 2003, its unfair competition claim in February 2003 and its tortious

interference claim in July 2003. A hearing on the remaining claim has been

ongoing since July 2003. The Avon Foundation believes that it has meritorious

defenses to the claims asserted by Pallotta and has filed a number of counter-

claims. The Avon Foundation is a registered 501(c)(3) charity and is a distinct

entity from Avon Products, Inc., which is not a party to these proceedings.

While it is not possible to predict the outcome of litigation, management

believes that these proceedings should not have a material adverse effect

on the Consolidated Financial Statements of the Company.

Blakemore, et al. v. Avon Products, Inc., et al. is a purported class action com-

menced in March 2003 in the Superior Court of the State of California on

behalf of “all persons in the United States who were or are Independent Sales

Representatives (‘ISRs’) for Avon from 1999 to the date of judgment who were

shipped product by Avon that the ISR did not order, who were charged for such

product and who were not credited for such charges.” The initial complaint

demanded unspecified damages and equitable, injunctive and/or declaratory

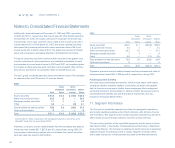

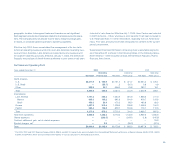

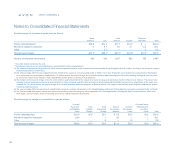

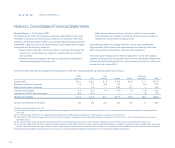

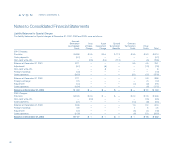

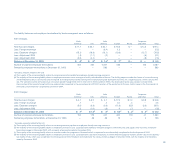

Notes to Consolidated Financial Statements

notes to statements

94