Avon 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

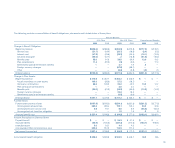

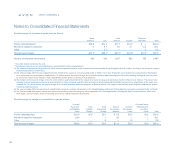

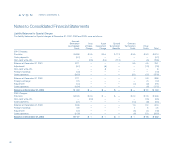

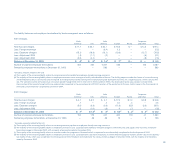

Accrued severance and related costs are expenses associated with domestic

and international facility rationalizations and workforce reduction programs.

Employee severance costs were accounted for in accordance with the

Company’s existing FAS No. 112, “Employers’ Accounting for Postemploy-

ment Benefits,” severance plans or in accordance with other accounting liter-

ature. Approximately 3,500 employees, or 8.0% of the total workforce, will

receive severance benefits. Approximately 85% of the number of employees

to be terminated related to facility rationalizations, which represents employ-

ees within the manufacturing and distribution functions. The remainder of

the employee severance costs are associated with workforce reduction pro-

grams, which span much of the organization including the functional areas of

marketing, sales, information technology, human resources, finance, research

and development, legal, communications and strategic planning. The facility

rationalizations will primarily result in expanding production in existing facili-

ties (Europe and U.S.), building a new facility (Latin America) and sourcing

product through third party vendors (North America including the U.S.). In

certain circumstances, employees terminated due to facility rationalizations

will need to be replaced. The majority of the employee severance costs

were paid in 2002 and 2003 in accordance with the original plan.

The Cost of sales charge represented losses for inventory write-downs asso-

ciated with a facility closure in Puerto Rico.

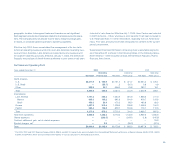

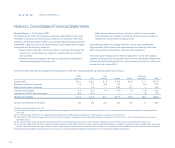

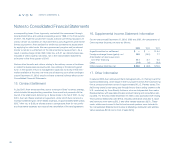

Primarily as a result of facility rationalizations, management identified indica-

tors of possible impairment of certain long-lived assets, consisting of buildings

and improvements, equipment and other assets. In assessing and measuring

impairment of long-lived assets, the Company applied the provisions of FAS

No. 121, “Accounting for the Impairment of Long-Lived Assets and for Long-

Lived Assets to Be Disposed Of.” Recoverability of assets to be held and used

was measured by the comparison of the carrying amount of the assets with

expected future cash flows of the assets (assets were grouped at the lowest

level for which there were identifiable cash flows that were largely independent

of the cash flows of other groups of assets). As a result of the impairment

review, an asset impairment charge was recorded. Approximately $4.0 of the

asset impairment charge related to the closure of a facility in Puerto Rico and

reflected the reduction in the carrying value of equipment to its estimated fair

market value based on selling prices for comparable equipment. The equip-

ment was sold in the first half of 2002. The remaining charge related to assets

(leasehold improvements and other assets) that have been abandoned.

Special termination benefits represent the impact of employee terminations on

the Company’s benefit plans in the U.S. and certain international locations. In

accordance with FAS No. 88, “Employers’ Accounting for Settlements and

Curtailment of Defined Benefit Pension Plans and for Termination Benefits,” the

plans experienced a net loss from curtailment and special termination benefits

of $1.3 and $9.9, respectively. The curtailment charge reflected the difference

between the liabilities assuming all of the participants terminate as of their sever-

ance date versus the ongoing liability for these participants under FAS No. 87 at

the curtailment date assuming continued active employment. The special ter-

mination benefits included a loss resulting from an increase in a liability due to

additional service and pay earned during the severance period, coupled with

an additional liability attributable to paying benefits at an actual rate versus

an assumed rate.

Contract termination costs primarily represented lease buyout costs related to

facility closures in North America (including the U.S.) and cancellation of a

contract with a third-party supplier of warehousing and logistical services in

the U.S.

Accrued facility rationalization and other costs primarily represented incremen-

tal costs associated with the facility rationalizations, including administrative

expenses during the shutdown period, employee and union communication

costs and legal fees.

While project plans associated with these initiatives have not changed, the

Company has experienced favorable adjustments to its original cost estimates.

As a result, the Company reversed $7.3 pretax ($5.2 after tax, or $.02 per diluted

share) in 2002 and $2.1 pretax ($1.3 after tax, or $.006 diluted share) in 2003,

against the Special charge line in the Consolidated Statements of Income, where

the estimates were originally recorded. The favorable adjustments in 2002 primar-

ily related to certain employees pursuing reassignments in other Avon locations,

as well as lower severance costs resulting from higher than anticipated lump-sum

distributions (associates who elect lump-sum distributions do not receive benefits

during the severance period). The favorable adjustments in 2003 primarily related

to certain employees pursuing reassignments to other locations and favorable

contract termination negotiations.

89