Avon 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

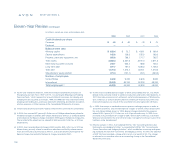

97

18. Acquisition

In the second quarter of 2003, Avon purchased the outstanding 50% of shares

in its Turkish joint venture business, Eczacibasi Avon Kozmetik (EAK) from its

partner, Eczacibasi Group, for $18.4, including transaction costs. As a result of

the acquisition agreement, Avon consolidated the remaining 50% of its Turkish

joint venture business in the second quarter of 2003. Prior to the second quar-

ter of 2003, the investment was accounted for under the equity method. The

impact on Net sales and Operating profit in 2003 was $47.2 and $14.6, respec-

tively. Avon Turkey is included in Avon’s European operating segment. Avon

allocated approximately $17.0 of the purchase price to goodwill.

19. Subsequent Events

On January 14, 2004, Avon entered into an agreement to purchase 20%

of the outstanding shares in its two joint venture subsidiaries in China from

a minority interest shareholder, for approximately $50.0 (407.0 Chinese

renminbi). The transfer of shares is contingent on approval by various Chinese

government authorities. Avon currently consolidates its 73.845% interest in

these subsidiaries. The purchase of these shares will not have a material

impact on Avon’s consolidated Net income.

On February 3, 2004, Avon announced an increase in its quarterly cash divi-

dend to $.28 per share from $.21 per share. The first dividend at the new rate

will be paid on March 1, 2004, to shareholders of record on February 14,

2004. On an annualized basis, the new dividend rate is $1.12 per share.

On February 3, 2004, Avon also announced a two-for-one stock split in the

form of a dividend of one share of common stock in respect of each share of

common stock issued and outstanding or held in treasury, subject to share-

holder approval at the May 6, 2004 annual meeting of shareholders of an

amendment to the Company’s Restated Certificate of Incorporation to increase

the number of authorized shares. If the stock split is approved, the new

annual dividend rate will be $.56 per share (quarterly rate of $.14 per share).