Avon 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

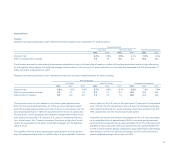

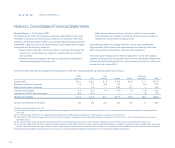

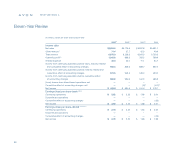

2002 Special charges (net of adjustment to the 2001 charges) by category of expenditures were as follows:

Accrued

Severance Cost Contract

and Related of Sales Termination Other

Costs Charge Costs Costs Total

Supply chain $14.2 $1.4 $ .1 $ 1.8 $17.5

Workforce reduction programs 11.0 — — .6 11.6

Sales transformation initiatives 9.7 .6 2.3 1.9 14.5

Total accrued charges 34.9 2.0 2.4 4.3 43.6

Adjustment to 2001 Special charges (5.7) — — (1.6) (7.3)

Net accrued charges $29.2 $2.0 $2.4 $ 2.7 $36.3

91

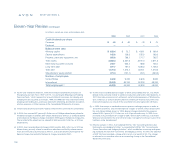

Accrued severance and related costs are expenses, both domestic and

international, associated with supply chain initiatives (primarily North America,

Europe and the Pacific), workforce reduction programs (all segments except

the Pacific) and sales transformation initiatives (primarily Europe, the Pacific

and U.S). Employee severance costs were accounted for in accordance with the

Company’s existing FAS No. 112, “Employers’ Accounting for Postemployment

Benefits,” severance plans, or with other accounting literature. Approximately

1,000 employees, or 2.0% of the total workforce, will receive severance benefits.

Approximately 45% of the number of employees to be terminated related to

facility rationalizations and the supply chain function, which primarily represents

employees within the manufacturing and distribution functions. Approximately

20% of the number of employees to be terminated related to the sales transfor-

mation initiatives, which represent employees within the sales function. The

remainder of the employee severance costs is associated with workforce reduc-

tion programs, which span much of the organization including the functional

areas of marketing, information technology, human resources, research and

development and strategic planning.

The Cost of sales charge for inventory write-downs primarily represents

losses associated with store and branch closures (primarily Pacific) as well

as the discontinuation of selected product lines (Europe).

Contract termination costs primarily represent lease buyout costs related to

store and branch closures (primarily Pacific) and contract cancellation fees

with store owners (Pacific).

Other costs primarily represent administrative expenses associated with a

facility rationalization, employee and union communication costs, pension

termination benefits and legal and professional fees (primarily Europe).

While project plans associated with these initiatives have not changed, the

Company has experienced favorable adjustments to its original cost estimates.

As a result, the Company reversed $1.8 pretax ($1.3 after tax, or $.005 per

diluted share) in 2003, against the Special charge line in the Consolidated

Statements of Income, where the estimates were originally recorded. The favor-

able adjustments in 2003 primarily relate to certain employees pursuing reas-

signments to other locations and favorable contract termination negotiations,

partially offset by higher than expected severance costs for certain initiatives.