Avon 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

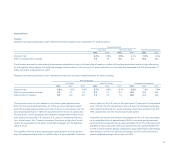

Additionally, Avon held assets at December 31, 2003 and 2002, amounting

to $22.5 and $10.1, respectively, that may be used for other benefit payments.

At December 31, 2003, the assets consisted of corporate-owned life insur-

ance policies with a cash surrender value of $20.3 and mutual funds with a

market value of $2.2. At December 31, 2002, the assets consisted of corpo-

rate-owned life insurance policies with a cash surrender value of $8.3 and

mutual funds with a market value of $1.8. The assets are recorded at market

value, with increases or decreases reflected in the Statement of Income.

The equity securities and fixed-income portfolio included in the grantor trust

and the mutual funds, discussed above, are classified as available-for-sale

and recorded at current market value. In 2003 and 2002, net unrealized gains

and losses on these securities were recorded in Accumulated other compre-

hensive loss (see Note 5, Accumulated Other Comprehensive Loss).

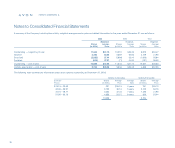

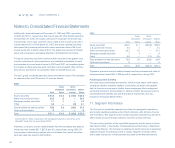

The cost, gross unrealized gains and losses and market value of the available-

for-sale securities as of December 31, were as follows:

2003

Gross Gross

Unrealized Unrealized Market

Cost Gains Losses Value

Equity securities $ 44.5 $ 2.3 $ (16.0) $ 30.8

State and municipal bonds* 21.0 .9 — 21.9

Mortgage backed securities* 1.7 .1 — 1.8

Other 3.6 — (.5) 3.1

Total available-for-sale securities 70.8 3.3 (16.5) 57.6

Cash and equivalents .3 — — .3

Total $ 71.1 $ 3.3 $ (16.5) $ 57.9

* At December 31, 2003, investments with scheduled maturities in two to five years

totaled $7.5 and after five years totaled $15.2.

Payments, proceeds and net realized losses from the purchases and sales of

these securities totaled $27.7, $27.6 and $.2, respectively, during 2003. For

the purpose of determining realized gains and losses, the cost of securities

sold was based on specific identification.

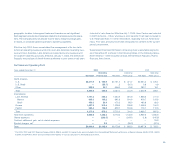

2002

Gross Gross

Unrealized Unrealized Market

Cost Gains Losses Value

Equity securities $44.0 $ .7 $(20.8) $23.9

U.S. government bonds 2.3 .1 — 2.4

State and municipal bonds 20.1 1.0 — 21.1

Mortgage backed securities .7 .1 — .8

Other 3.8 — (1.2) 2.6

Total available-for-sale securities 70.9 1.9 (22.0) 50.8

Cash and equivalents .6 — — .6

Total $71.5 $1.9 $(22.0) $51.4

Payments, proceeds and net realized losses from the purchases and sales of

these securities totaled $30.4, $33.8 and $.5, respectively, during 2002.

Postemployment Benefits

Avon provides postemployment benefits, which include salary continuation,

severance benefits, disability benefits, continuation of health care benefits

and life insurance coverage to eligible former employees after employment

but before retirement. At December 31, 2003 and 2002, the accrued cost for

postemployment benefits was $42.8 and $37.9, respectively, and was

included in Employee Benefit Plans.

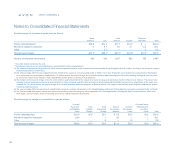

11. Segment Information

The Company’s reportable segments are based on geographic operations

and include operating business units in North America, Latin America, Europe

and the Pacific. The segments have similar business characteristics and each

offers similar products through common customer access methods.

The accounting policies of the reportable segments are the same as those

described in Note 1, Description of the Business and Summary of Significant

Accounting Policies. The Company evaluates the performance of its operating

segments based on operating profits or losses. Segment revenues reflect

direct sales of products to Representatives based on the Representative’s

Notes to Consolidated Financial Statements

notes to statements

84