Avon 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

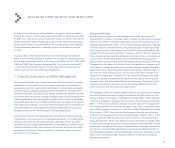

Long-Lived Assets

Effective January 1, 2002, Avon adopted FAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets,” which addresses the account-

ing and reporting for the impairment and disposal of long-lived assets. The

adoption of FAS No. 144 did not have a material impact on the Consolidated

Financial Statements.

Asset Retirement Obligations

In August 2001, the Financial Accounting Standards Board (“FASB”) issued

FAS No. 143, “Accounting for Asset Retirement Obligations,” which addresses

the accounting and reporting for obligations associated with the retirement of

tangible long-lived assets and the associated retirement costs. FAS No. 143

was effective January 1, 2003, for Avon. The adoption of FAS No. 143 did not

have a material impact on the Consolidated Financial Statements.

Accounting for Costs Associated with Exit or Disposal Activities

In June 2002, the FASB issued FAS No. 146, “Accounting for Costs Associated

with Exit or Disposal Activities.” This statement supersedes EITF No. 94-3,

“Liability Recognition for Certain Employee Termination Benefits and Other

Costs to Exit an Activity (Including Certain Costs Incurred in a Restructuring).”

FAS No. 146 requires that a liability for a cost associated with an exit or disposal

activity be recognized when the liability is incurred. Under EITF 94-3, a liability is

recognized at the date an entity commits to an exit plan. FAS No. 146 also estab-

lishes that the liability should initially be measured and recorded at fair value. The

provisions of FAS No. 146 were effective for any exit and disposal activities initi-

ated after December 31, 2002.

Guarantees

In November 2002, the FASB issued Interpretation (“FIN”) No. 45, “Guarantor’s

Accounting and Disclosure Requirements for Guarantees, Including Indirect

Guarantees of Indebtedness of Others,” which requires certain guarantees to

be recorded at fair value rather than the current practice of recording a liability

only when a loss is probable and reasonably estimable and also requires a

guarantor to make new guaranty disclosures, even when the likelihood of mak-

ing any payments under the guarantee is remote. The accounting requirements

of FIN No. 45 was effective for guarantees issued or modified after December 31,

2002, and the disclosure requirements are effective for financial statements of

interim or annual periods ending after December 15, 2002. The adoption of FIN

No. 45 did not have a material impact on the Consolidated Financial Statements.

See Consolidation of Variable Interest Entities below.

Accounting for Stock-Based Compensation

In December 2002, the FASB issued FAS No. 148, “Accounting for Stock-

Based Compensation – Transition and Disclosure,” which provides compa-

nies with three transition methods if they choose to adopt the accounting

provisions of FAS No. 123. FAS No. 148 also requires new disclosure require-

ments that are incremental to FAS No. 123, which have been included in

Note 1, Description of the Business and Summary of Significant Accounting

Policies, and Note 8, Long-Term Incentive Plans.

Consolidation of Variable Interest Entities

In January 2003, the FASB issued FASB Interpretation No. 46, “Consolidation

of Variable Interest Entities” (“FIN 46”), which changes the criteria by which one

company includes another entity in its consolidated financial statements. FIN

46 requires a variable interest entity to be consolidated by a company if that

company is subject to a majority of the risk of loss from the variable interest

entity’s activities or entitled to receive a majority of the entity’s residual returns

or both. The consolidation requirements of FIN 46 were effective immediately

for variable interest entities created after January 31, 2003, and July 1, 2003,

for variable interest entities created prior to February 1, 2003. In October 2003,

the FASB deferred the effective date from July 1, 2003, to December 31, 2003,

for variable interest entities created prior to February 1, 2003. Avon elected to

adopt FIN 46 on July 1, 2003. Avon has a 40% interest in Mirabella Realty

Company, (“Mirabella”), a Philippine company formed to purchase land in the

Philippines. The remaining 60% interest is held by Company-sponsored retire-

ment plans. Prior to July 1, 2003, the investment was accounted for under the

equity method. Avon holds a variable interest in Mirabella because Avon guar-

antees $2.3 of Mirabella’s third-party borrowings. As a result, Mirabella was

consolidated beginning July 1, 2003. Mirabella’s net assets totaled $.5 at

December 31, 2003, and consisted primarily of land of $3.9 and debt of $2.3.

The consolidation of Mirabella did not have a material impact on the

Consolidated Financial Statements.

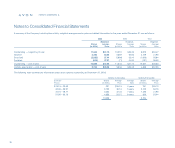

Notes to Consolidated Financial Statements

notes to statements

66