Avon 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

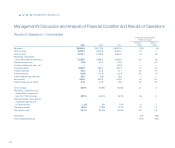

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

Turkish subsidiary which was consolidated beginning in the second quarter of

2003 (see Note 18, Acquisition) and costs of $10.5 (severance and asset write-

downs) associated with the repositioning of the beComing line of products (see

Note 17, Other Information). These increases in expenses were partially offset by

incremental net savings from workforce reduction programs associated with

Avon’s Business Transformation initiatives of approximately $85.0 and lower

bonus accruals of approximately $32.0.

As a percentage of Total revenue, Marketing, distribution and administrative

expenses increased .5 point in 2003 due to higher expense ratios in North

America (1.4 points, which increased the consolidated ratio by .6 point) and

the Pacific (1.2 points, which increased the consolidated ratio by .2 point),

partially offset by lower expense ratios in Europe (.9 point, which reduced the

consolidated ratio by .2 point) and Latin America (.3 point, which reduced the

consolidated ratio by .1 point).

Marketing, distribution and administrative expenses increased $88.5 in

2002 primarily due to a 4% sales increase (which resulted in an increase in

expenses of approximately $69.0), an increase in consumer-related invest-

ments of $22.0, (including brochure enhancements and sampling), higher

bonus accruals of $16.0 and merit salary increases of $15.0 for certain mar-

keting, distribution and administrative personnel around the world. These

increases in expenses were partially offset by net savings from workforce

reduction programs associated with Avon’s Business Transformation initia-

tives of $30.0.

As a percentage of Total revenue, Marketing, distribution and administrative

expenses decreased .3 point in 2002 due to lower expense ratios in Europe

(2.0 points, which reduced the consolidated ratio by .4 point), the Pacific (1.5

points, which reduced the consolidated ratio by .2 point) and North America

(.1 point, which reduced the consolidated ratio by .1 point), partially offset by

a higher expense ratio in Latin America (.3 point, which increased the consoli-

dated ratio by .1 point). Additionally, the consolidated expense ratio was neg-

atively impacted by greater contributions from markets with higher expense

ratios (which increased the consolidated ratio by .3 point).

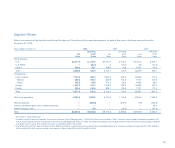

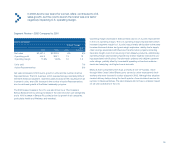

See the “Segment Review” sections of Management’s Discussion and Analysis

of Financial Condition and Results of Operations for additional information

related to changes in expense ratios by segment.

Other Expense (Income)

Interest expense decreased in both 2003 and 2002 primarily as a result of

Avon having interest rate swaps that convert approximately 90% of its fixed

rate debt to a floating rate based on LIBOR (see Note 7, Financial Instruments

and Risk Management) during a period of declining rates. In 2003, the lower

interest expense was also driven by lower average debt balances.

Interest income decreased in 2003 primarily due to lower average cash and

cash equivalent balances during 2003. Interest income increased in 2002 pri-

marily due to higher average cash and cash equivalent balances during 2002.

Other expense (income), net was unfavorable in 2003 as compared to 2002 by

$38.5 primarily due to unfavorable foreign exchange of $31.9 and the write-off

of deferred debt issue costs of $6.4 in the third quarter of 2003 related to Avon’s

convertible notes (see Note 4, Debt and Other Financing). The foreign exchange

variance was mainly due to gains of $27.8 in 2002 on net U.S. dollar denomi-

nated assets, primarily in Argentina, Venezuela, Brazil and Mexico.

Other expense (income), net was favorable in 2002 as compared to 2001,

mainly due to favorable foreign exchange in 2002 ($23.7) and a charge in

2001 related to the settlement of a disputed excise tax liability in Argentina

($6.4) (see Note 14, Contingencies). Net foreign exchange was favorable in

2002 primarily due to an increase in foreign exchange gains of $19.8 on net

U.S. dollar denominated assets primarily in Argentina, Venezuela, Brazil

and Mexico.

Effective Tax Rate

The effective tax rate was lower in 2003 primarily due to tax audit settlements

and an interest refund from the IRS, which, collectively, reduced the effective rate

by approximately 2.5 points. Additionally, the 2003 rate was impacted favorably

by changes in the earnings mix and tax rates of international subsidiaries.

30