Avon 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

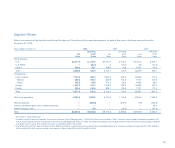

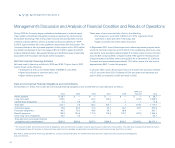

Segment Review – 2002 Compared to 2001

Europe

%/Point Change

Local

2002 2001 US $ Currency

Net sales $1,228.6 $1,008.5 22% 19%

Operating profit 208.8 164.0 27 25

Operating margin 16.9% 16.2% .7 .7

Units sold 27%

Active Representatives 22%

Net sales increased in U.S. dollars and local currency in 2002 driven by sub-

stantial growth in units and the number of active Representatives with the fol-

lowing markets having the most significant impact:

• In the markets of Central and Eastern Europe, Net sales in U.S. dollars

and local currency grew significantly, primarily in Russia where local

currency sales nearly doubled. In Russia, units doubled as a result of

increased market coverage and incremental consumer investments

(including advertising and sampling) and strategic pricing investments,

as well as an improvement in Russia’s economic environment.

• In the United Kingdom, Net sales in U.S. dollars and local currency

increased faster than the market driven by increased consumer invest-

ments such as promotional spending.

The increase in operating margin in Europe was most significantly impacted

by the following markets:

• In Central and Eastern Europe, operating margin improved (which

increased segment margin by 1.0 point) primarily due to an improve-

ment in Russia’s expense ratio resulting from significant sales growth

and general cost containment initiatives, partially offset by incremental

consumer-related spending, such as advertising. The lower expense

ratio was partially offset by a lower gross margin due to strategic pricing

investments and other consumer motivation programs.

• In South Africa, operating margin improved (which increased segment

margin by .3 point) primarily due to a lower expense ratio resulting from

higher sales.

• In the United Kingdom, operating margin improved (which increased

segment margin by .1 point) due to a decrease in the expense ratio

resulting from general cost containment initiatives, partially offset by

increased spending for special promotional offers and a decrease in

gross margin. Gross margin declined due to an increase in the cost of

imported products, resulting from the strengthening of the Euro and

Polish zloty against the British pound, and an investment in supply chain

Business Transformation initiatives including expenses associated with

the closing of a manufacturing facility.

• In Western Europe, excluding the United Kingdom, operating margin

declined (which reduced segment margin by 1.0 point) primarily due to

a lower gross margin, most significantly in Germany, due to strategic

pricing investments, increased consumer investments, an unfavorable

product mix, and higher expense ratios in Germany and Italy as

a result of fixed costs on a lower sales base.

Operating margin also improved due to greater contributions from countries

with higher operating margins (which increased segment margin by .9 point).

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

40