Avon 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension and Postretirement Benefits

In December 2003, the FASB issued a revised FAS No. 132, “Employers’

Disclosures about Pensions and Other Postretirement Benefits,” to improve

financial statement disclosures for defined benefit plans. FAS No. 132 requires

new disclosure requirements, which have been included in Note 10, Employee

Benefit Plans.

In January 2004, the FASB issued FASB Staff Position (“FSP”) No. 106-a,

“Accounting and Disclosure Requirements Related to the Medicare Prescription

Drug, Improvement and Modernization Act of 2003” (the “Act”). Among other

things, the new law will expand Medicare to include an outpatient prescription

drug benefit beginning in 2006. Under FSP No. 106-a, companies may choose

to report the effects of the Act in financial statements for the period that covers

the date of the enactment (December 8, 2003) or they may choose to defer rec-

ognizing the effects of the Act until guidance is issued by the FASB. Avon has

elected to defer accounting for the effects of the Act. Accordingly, Avon’s accu-

mulated postretirement obligation and net postretirement health care costs do

not reflect the effects of the Act on the plans. Avon is currently assessing the

implications of this Act on the Consolidated Financial Statements.

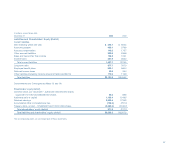

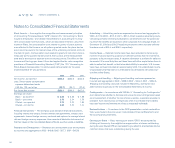

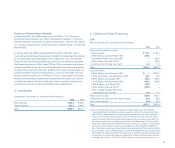

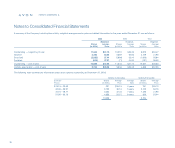

3. Inventories

Inventories at December 31 consisted of the following:

2003 2002

Raw materials $152.0 $165.6

Finished goods 501.4 449.1

Total $653.4 $614.7

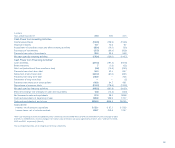

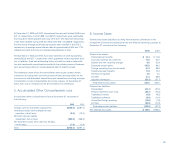

4. Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2003 2002

Debt maturing within one year:

Notes payable $ 39.7 $ 63.7

6.90% Notes, due November 2004 200.0 —

Convertible Notes, due July 2020 (a) —438.4

6.25% Notes, due May 2018 (b) —100.0

Current portion of long-term debt 4.4 3.1

Total $244.1 $605.2

Long-term debt:

6.90% Notes, due November 2004 $ — $200.0

1.06% Yen Notes, due September 2006 84.2 75.0

6.55% Notes, due August 2007 100.0 100.0

7.15% Notes, due November 2009 300.0 300.0

4.625% Notes, due May 2013 (b) 105.0 —

4.20% Notes, due July 2018 (c) 248.8 —

Other, payable through 2018 with

interest from 1% to 19%(d) 11.8 9.7

Total long-term debt 849.8 684.7

Adjustments for debt with fair value hedges (e) 32.3 85.4

Less current portion (4.4) (3.1)

Total $877.7 $767.0

(a) The Convertible Notes were zero coupon convertible senior notes due 2020 (the

“Convertible Notes”) with $840.8 principal amount at maturity. The Convertible Notes

had a 3.75% yield to maturity and were convertible at any time into Avon’s common

stock at a conversion rate of 8.2723 shares of common stock per $1,000 principal

amount at maturity of the Convertible Notes (equivalent to a conversion price of $57.50

per share based on the initial offering price of the Convertible Notes). The Convertible

Notes were redeemable at the option of Avon on or after July 12, 2003, at a redemption

price equal to the issue price plus accrued original issue discount to the redemption

date. The holders could require Avon to purchase all or a portion of the Convertible Notes

on July 12, 2003, July 12, 2008, and July 12, 2013, at the redemption price per Convertible

Note of $531.74, $640.29 and $771.00, respectively. The holders could also require Avon

to repurchase the Convertible Notes if a fundamental change, as defined, involving Avon

occurred prior to July 12, 2003. Avon had the option to pay the purchase price or, if a

67