Avon 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On June 23, 2003, Avon entered into two 15-year interest rate swap contracts

with notional amounts that totaled $250.0 to effectively convert the fixed inter-

est on the 4.20% Notes to a variable interest rate, based on LIBOR.

On October 8, 2003, Avon terminated two interest rate swap contracts, each

of which had a notional amount of $100.0 that had been scheduled to termi-

nate on November 15, 2004. These swaps had effectively converted the fixed

interest rate on the $200.0, 6.90% Notes due 2004 (“6.90% Notes”) to a float-

ing rate based on LIBOR, with the interest rate set at the beginning of each

calculation period.

At inception, the terminated swaps had been designated as hedges of Avon’s

6.90% Notes and accordingly both the interest rate swaps and underlying

debt were adjusted to reflect their fair values at termination. Effective with the

termination of these swaps, the fair value adjustment to the underlying debt of

$8.8 is being amortized over the remaining term of the 6.90% Notes.

Simultaneous with the termination of those swaps, Avon entered into two new

interest rate swap contracts, each with a notional amount of $100.0. These

new interest rate swaps are scheduled to terminate on November 15, 2004,

and will effectively convert the fixed interest rate on the 6.90% Notes to a

floating rate based on LIBOR, with the interest rate set at the end of each cal-

culation period. The new swaps have been designated as fair value hedges of

the 6.90% Notes.

Foreign Currency Risk

Avon uses foreign currency forward contracts and options to hedge portions

of its forecasted foreign currency cash flows resulting from intercompany roy-

alties, intercompany loans, and other third-party and intercompany foreign

currency transactions where there is a high probability that anticipated expo-

sures will materialize. These contracts have been designated as cash flow

hedges. At December 31, 2003, the primary currencies for which Avon has net

underlying foreign currency exchange rate exposures are the U.S. dollar ver-

sus the Argentine peso, Brazilian real, British pound, Chinese renminbi, the

Euro, Japanese yen, Mexican peso, Philippine peso, Polish zloty, Russian

ruble and Venezuelan bolivar.

For the years ended December 31, 2003 and 2002, the ineffective portion of

Avon’s cash flow hedging instruments was not material. In addition, the portion

of hedging instruments excluded from the assessment of hedge effectiveness

(time value of options prior to June 1, 2001) was not material. For the years

ended December 31, 2003 and 2002, the net gains or losses reclassified from

OCI to earnings for cash flow hedges that had been discontinued because the

forecasted transactions were not probable of occurring, were not material.

At December 31, 2003, Avon held foreign currency forward contracts and

option contracts, principally for the Euro, British pound, Polish zloty, Japanese

yen, Canadian dollar, Mexican peso, Hungarian forint and Russian ruble, with

aggregate notional amounts totaling $477.1 and $43.5, respectively, for both

the purchase and/or sale of foreign currencies.

At December 31, 2003, the maximum remaining term over which Avon was

hedging exposures to the variability of cash flows for all forecasted transactions

was 12 months. As of December 31, 2003, Avon expects to reclassify $2.4 ($1.6,

net of taxes) of net losses on derivative instruments designated as cash flow

hedges from Accumulated other comprehensive loss to earnings during the next

12 months due to (a) foreign currency denominated intercompany royalties, (b)

intercompany loan settlements and (c) foreign currency denominated purchases

or receipts.

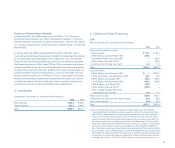

For the years ended December 31, 2003 and 2002, cash flow hedges impacted

Accumulated other comprehensive loss as follows:

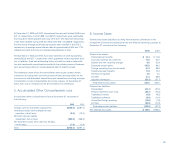

2003 2002

Net derivative losses at beginning of year $(2.6) $(2.2)

Net (losses) gains on derivative instruments,

net of taxes of $.0 and $.2 — .4

Reclassification of net losses (gains) to

earnings, net of taxes of $.6 and $.4 1.0 (.8)

Net derivative losses at end of year,

net of taxes of $.8 and $1.4 $(1.6) $(2.6)

Due to its large international exposure, Avon uses foreign cur-

rency forward contracts and options to hedge portions of its

foreign currency cash flows.

73