Avon 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

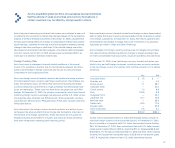

Avon Mexico’s gain from a sale of property in Mexico City,

as part of its move to a new distribution facility, contributed to

the region’s 1.4 points of operating margin expansion in 2003.

In February 2003, the Venezuelan government implemented exchange controls

and fixed the exchange rate for the Venezuelan bolivar (“VEB”) at 1598 per U.S.

dollar. In February 2004, the Venezuelan government devalued the official

exchange rate from 1598 to 1918 VEB for one U.S. dollar. Venezuela’s political

and economic situation continues to impact Avon’s ability to conduct normal

business operations as well as to obtain foreign currency to pay for imported

products. The lack of foreign currency has required Avon’s subsidiary in

Venezuela (“Avon Venezuela”) to rely on parent company support in order to

continue importing material for its operations. Avon Venezuela’s results of oper-

ations in U.S. dollars have been and will continue to be negatively impacted

until there is a significant improvement in the country’s political and economic

situation and foreign currency is made available to importers. In spite of the dif-

ficulty to obtain foreign currency for imports, in the fourth quarter of 2003

Avon Venezuela remitted a $14.5 dividend and a $2.8 royalty to its parent

company at the official rate of 1598 VEB per U.S. dollar.

From January 1, 2003 until the February 2004 devaluation, Avon has used the

official rate of 1598 VEB for one U.S. dollar to translate the financial state-

ments of Avon Venezuela into U.S. dollars. For the year ended December 31,

2003, Avon Venezuela’s Net sales and Operating profit represented approxi-

mately 2% and 3% of consolidated Net sales and Operating profit, respec-

tively. As of December 31, 2003, Avon Venezuela’s Total assets and Total

liabilities represented approximately 2% and 1% of consolidated Total assets

and Total liabilities, respectively. Using an exchange rate of 1918 VEB instead

of the official rate of 1598 VEB per U.S. dollar to translate the 2003 financial

statements of Avon Venezuela would have decreased Avon Venezuela’s Net

income for the year ended December 31, 2003, by $4.3, and would have

decreased equity as of December 31, 2003, by $11.4, including the impact

of translating the income statement at the higher rate.

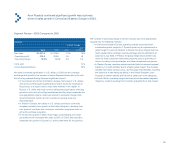

In 2003, there was increased foreign direct investment into Brazil as a result

of improved investor confidence and higher exports contributing to a 23%

appreciation in the real during 2003. Continued strength in the real in 2004

could have a favorable impact on Avon Brazil’s U.S. dollar results. In 2003,

Avon Brazil represented 7% and 9% of Avon’s consolidated Net sales and

Operating profit, respectively.

In Argentina, the economy improved significantly in 2003 as the weaker cur-

rency spurred exports thereby contributing to the country’s trade surplus.

Although the currency has stabilized, the Argentine government has recently

begun negotiations on restructuring its defaulted debt. The results of these

negotiations may result in an economic slowdown and weaker currency, which

could negatively impact Avon Argentina’s U.S. dollar results in 2004. In 2003,

Avon Argentina represented 2% and 3% of Avon’s consolidated Net sales and

Operating profit, respectively.

37