Avon 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

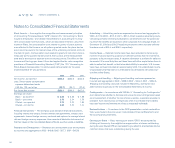

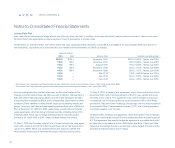

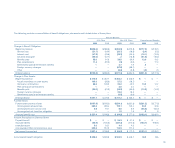

Deferred tax assets (liabilities) at December 31 were classified as follows:

2003 2002

Deferred tax assets:

Prepaid expenses and other $ 94.1 $110.5

Other assets 136.8 134.3

Total deferred tax assets 230.9 244.8

Deferred tax liabilities:

Income taxes (12.3) (13.1)

Deferred income taxes (50.6) (35.4)

Total deferred tax liabilities (62.9) (48.5)

Net deferred tax assets $168.0 $196.3

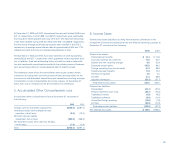

The valuation allowance primarily represents amounts for foreign operating

loss and capital loss carryforwards. The basis used for recognition of deferred

tax assets included the profitability of the operations and related deferred tax

liabilities. The net increase in the valuation allowance of $14.4 during 2003

was mainly due to several of the Company’s foreign entities continuing to

incur losses during 2003, thereby increasing the net operating loss carry-

forwards for which a valuation allowance was provided.

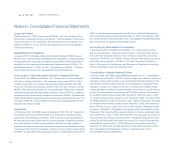

Income from continuing operations before taxes, minority interest and cumulative

effect of accounting changes for the years ended December 31 was as follows:

2003 2002 2001

United States $302.3 $271.1 $169.8

Foreign 691.2 564.5 519.9

Total $993.5 $835.6 $689.7

The provision for income taxes for the years ended December 31 was as follows:

2003 2002 2001

Federal:

Current $ 63.7 $ 60.9 $ 61.8

Deferred 27.1 36.4 (2.5)

90.8 97.3 59.3

Foreign:

Current 227.0 203.6 197.2

Deferred (6.1) (15.2) (20.4)

220.9 188.4 176.8

State and other:

Current 5.5 (3.3) 3.0

Deferred 1.7 9.9 1.2

7.2 6.6 4.2

Total $318.9 $292.3 $240.3

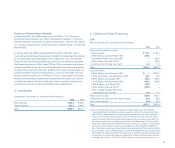

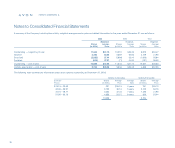

The effective tax rate for the years ended December 31 was as follows:

2003 2002 2001

Statutory federal rate 35.0% 35.0% 35.0%

State and local taxes, net of federal tax benefit .5 .5 .4

Tax-exempt operations —(.2) .6

Taxes on foreign income, including translation (1.7) (1.1) (.7)

Tax audit settlements and interest refund (2.5) ——

Other .8 .8 (.5)

Effective tax rate 32.1% 35.0% 34.8%

At December 31, 2003, Avon had foreign operating loss carryforwards of approx-

imately $164.6. The loss carryforwards expiring between 2004 and 2010 were

$101.1 and the loss carryforwards which do not expire were $63.5.

Notes to Consolidated Financial Statements

notes to statements

70