Avon 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

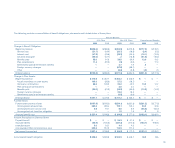

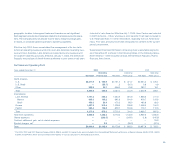

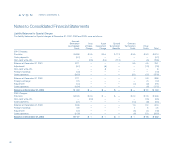

Special charges by business segment were as follows:

North Latin Corporate

America* U.S. America Europe and Other Total

Facility rationalizations** $16.8 $14.3 $17.7 $13.2 $ — $62.0

Workforce reduction programs .9 9.7 6.4 2.1 14.0 33.1

Other — 2.1 — — .2 2.3

Total accrued charges $17.7(1) $26.1(2) $24.1(3) $15.3(4) $14.2(5) $97.4

Number of employee terminations 362 460 2,007 533 125 3,487

** Excludes amounts related to the U.S.

** Includes accrued severance and related costs associated with facility rationalizations.

(1) The majority of the special charge within the North America segment related to a plan to outsource jewelry manufacturing through third party vendors, resulting in the closure of a jewelry

manufacturing facility in Puerto Rico.

(2) The special charge within the U.S. segment primarily related to the closure of a manufacturing facility in Suffern, New York. Production was moved to an existing facility in Springdale,

Ohio and to one or more third party manufacturers. To a lesser extent, the special charge also included workforce reduction programs within the marketing and supply chain functions

as well as the closure of four express centers (distribution centers where customers pick up products).

(3) The majority of the special charge within the Latin America segment related to the closure of a manufacturing and distribution facility in Mexico City, Mexico. The project also

included a construction plan to expand an existing facility in Celaya, Mexico, and the movement of the manufacturing and distribution functions on a staged basis to the newly con-

structed site. To a lesser extent, the special charge also included workforce reduction programs in Brazil (primarily in the supply chain function) and in Argentina and Mexico (across

numerous functional areas).

(4) The special charge within Europe primarily related to the closure of a manufacturing facility in the United Kingdom, with most of the production moving to an existing facility in Poland.

(5) The Corporate and other special charge was the result of workforce reduction programs which spanned much of the organization, including the legal, human resources, information

technology, communications, finance, marketing and research and development departments.

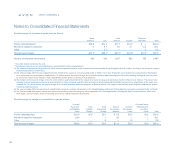

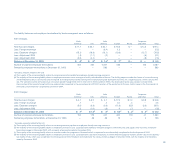

Special charges by category of expenditures were as follows:

Accrued Accrued Facility

Severance Cost Asset Special Contract Rationalization

and Related of Sales Impairment Termination Termination and Other

Costs Charge Charge Benefits Costs Costs Total

Facility rationalizations $42.9 $2.5 $5.1 $ 5.0 $2.2 $4.3 $62.0

Workforce reduction programs 26.9 — — 6.2 — — 33.1

Other — — .3 — 1.3 .7 2.3

Total accrued charges $69.8 $2.5 $5.4 $11.2 $3.5 $5.0 $97.4

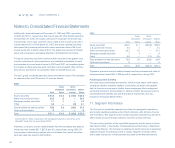

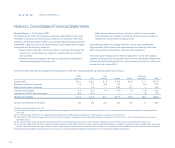

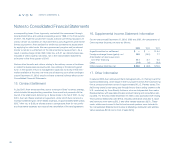

Notes to Consolidated Financial Statements

notes to statements

88