Avon 2003 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

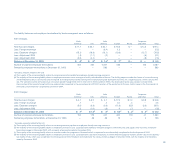

Special Charges — Third Quarter 2002

On September 30, 2002, the Company authorized a plan related to the imple-

mentation of its Business Transformation initiatives. In connection with these

initiatives, in the third quarter of 2002, Avon recorded Special charges of $43.6

pretax ($30.4 after tax, or $.12 per diluted share). These charges were primarily

associated with the following initiatives:

• Supply chain initiatives, including actions to improve efficiencies and

productivity in manufacturing, logistics, transportation and distribu-

tion activities;

• Workforce reduction programs focused on realigning the organization

and leveraging regional structures; and

• Sales transformation initiatives, including a shift to a more variable

expense base and changes in the selling structure due to a variety of

initiatives to contemporize the sales model.

Approximately 90% of the charge resulted in future cash expenditures.

Approximately 70% of these cash expenditures were made by December

2003. All payments are funded by cash flow from operations.

The third quarter charges (net of the $7.3 adjustment to the 2001 Special

charges as previously disclosed) were included in the Consolidated Statements

of Income as Special charges ($34.3) and as inventory write-downs, which were

included in Cost of sales ($2.0).

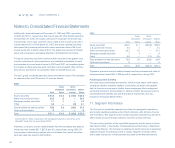

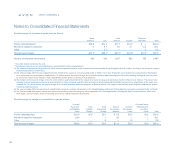

Notes to Consolidated Financial Statements

notes to statements

90

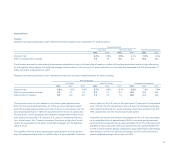

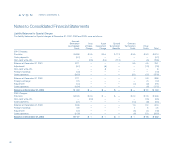

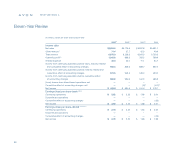

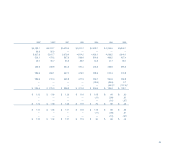

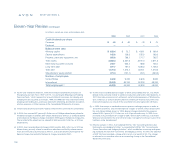

The third quarter 2002 Special charges (net of adjustment to the 2001 charges) affected all business segments as follows:

North Latin Corporate

America* U.S. America Europe Pacific and Other Total

Supply chain $ 3.1 $ 3.2 $ .8 $ 5.9 $4.5 $ — $17.5

Workforce reduction programs 1.6 1.2 3.3 1.6 — 3.9 11.6

Sales transformation initiatives — 1.8 — 10.0 2.7 — 14.5

Total accrued charges 4.7(1) 6.2(2) 4.1(3) 17.5(4) 7.2(5) 3.9(6) 43.6

Adjustment to 2001 Special charges (2.0) (4.4) — — — (.9) (7.3)

Net accrued charges $ 2.7 $ 1.8 $4.1 $17.5 $7.2 $3.0 $36.3

Number of employee terminations 152 179 241 302 119 41 1,034

*Excludes amounts related to the U.S.

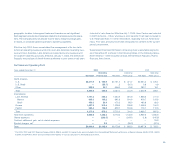

(1) The majority of the special charge within the North America segment related to the closure of a manufacturing facility in Canada and the transition of production to existing facilities

in the U.S.

(2) The special charge within the U.S. segment primarily related to workforce reduction programs within the sales and supply chain functions.

(3) The majority of the special charge within the Latin America segment included workforce reduction programs in Argentina, Central America and in Venezuela (across numerous

functional areas).

(4) The special charge within Europe primarily related to the restructuring of the sales force in certain Western European markets and the closure of a distribution facility in Italy.

(5) The special charge within the Pacific segment primarily related to supply chain initiatives in Japan, Australia and the Philippines. In addition, the special charge included costs associated

with the closure of stores and a procurement center in Hong Kong as well as contract cancellation fees and other costs resulting from the shutdown of certain sales branches in Malaysia.

(6) The Corporate and other special charge was the result of a workforce reduction program primarily within the information technology department.