Asus 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

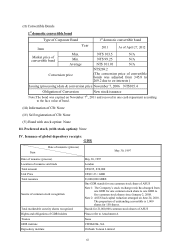

63

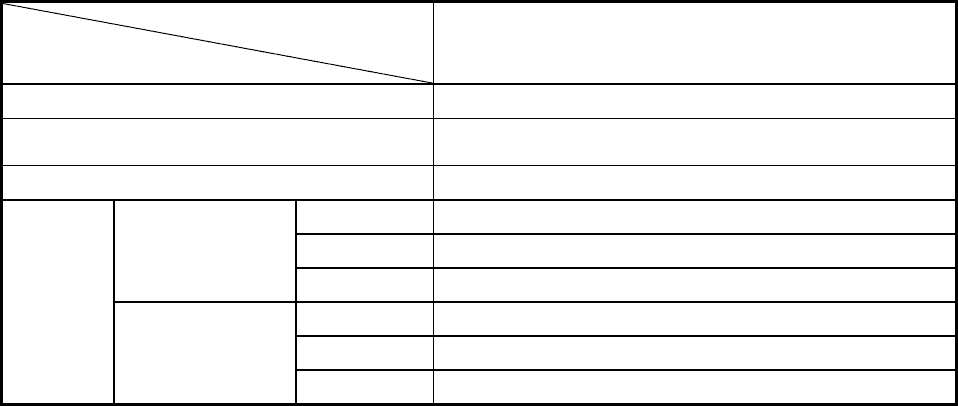

Date of issuance (process)

Item May 30, 1997

Outstanding GDR 6,319,844 GDRS (December 31, 2011)

Issuance and expense amortization throughout the

issuance period

It is to be amortized in three years on average after issuance

according to Article 243 of Company Law

GDR agreement and depository agreement Please refer to Attachment B

Market price

per unit

(US$)

2011

Max. US$ 50.80

Min. US$ 32.09

Average US$ 38.86

As of April 27, 2012

Max. US$ 50.00

Min. US$ 39.00

Average US$ 44.97

Attachment A

1. Voting rights: May not exercise voting rights directly but instructing the GDR institute to

exercise voting rights according to the GDR agreement.

2. Dividend distribution, stock option, and other rights:

(1) Entitled to distribution of dividend and stock shares just like the common shareholders of

ASUS. GDR institute may have GDR issued proportionally to shareholdings or increase

the common stock shares recognized with each GDR or have stock dividend sold on

behalf of GDR holders and with the income distributed to GDR holders proportionally.

(2) GDR institute may have the said rights provided to GDR holders within the scope defined

by the law of R.O.C. or international law, or, GDR institute may have the said rights sold

on behalf of GDR holder and with the income distributed to GDR holders proportionally.

Attachment B

1. GDR agreement:

(1) Transfer/split: The ownership of GDR is evidenced by EUROCLEAR and CEDEL book

transaction and split system.

(2) Dividend and others:

Cash dividend in US$ net of GDR institute fees and tax withholding is distributed to

GDR holders proportionally to their holdings.

For the distribution of stock dividend, GDR holders are to have the total GDR adjusted

proportionally to the shareholding ratio recognized with GDR holdings; also, adjusted

the GDR of GDR holders accordingly. GDR institute may have the income distributed

to GDR holders proportionally.

While having new stock shares issued for cash capitalization or arranging stock option,

GDR institute may (I) arrange stock subscription or (II) entrust the said right to GDR

holders; however, the new stock shares for cash capitalization are limited to the

exemption registered with SFC.

GDR institute must strive to have cash dividend and stock dividend distributed to GDR

holders.

(3) Voting rights: Unless otherwise agreed upon, GDR institute must base on the GDR

agreement, law of R.O.C., and the instruction of GDR holders to exercise the voting rights

of the marketable security recognized with GDR.

2. Depository agreement: