Asus 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

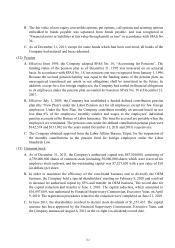

B. The investment income recognized under the equity method amounted to $7,274,803 and

$8,541,113 for the years ended December 31, 2011 and 2010, respectively which were

determined based on the investees’ audited financial statements. As of December 31, 2011 and

2010, the related long-term equity investments (deferred credits) amounted to $58,384,558

($793,962) and $46,223,721 ($757,225), respectively.

C. The effect of changes in unrealized gain (loss) on financial assets (including unrealized gain

on cash flow hedge) resulting from long-term equity investments were $948,996 and

($469,900) for the years ended December 31, 2011 and 2010, respectively.

D. The Company received cash dividends amounting to $1,303,736 and $4,018,073 for the years

ended December 31, 2011 and 2010, respectively, accounted for as a deduction from long-term

equity investments.

E. The change of long-term equity investments accounted for under the equity method are as

follows:

(A) On June 1, 2010, the Company transferred the OEM assets and business (the

Company’s long-term equity investment in PEGA) to PII. PII then issued new shares to

the Company and its shareholders as consideration. The Company then obtained 25%

ownership of the consolidated PEGA and PII (PII is the dissolved company). The

long-term investment decreased by $70,197,726 after this transaction.

(B) AHL decreased its capital and the Company received a return of capital amounting to

$1,061,951 for the year ended December 31, 2010.

(C) SYT had a cash capital increase on January 10, 2010, and the Company invested

$2,500,400. After the capital increase, the Company held 45,120,000 shares of SYT,

representing 47% ownership.

(D) As approved by the authorities and in compliance with the related regulations, SYT had

obtained 86,220,000 shares of AAEON, and the merger record date was set on June 1,

2011. After the merger, SYT was the surviving company, and SYT has been approved

by the authorities on July 4, 2011 to change its name to AAEON.

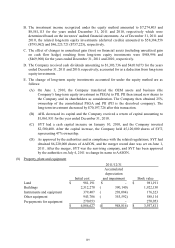

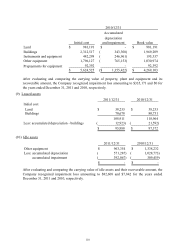

(8) Property, plant and equipment

Accumulated

depreciation

Initial cost and impairment Book value

Land 981,191$ -$ 981,191$

Buildings 2,312,270 390,140)( 1,922,130

Instruments and equipment 379,407 203,084)( 176,323

Other equipment 943,706 355,592)( 588,114

Prepayments for equipment 270,053 - 270,053

4,886,627$ 948,816)($ 3,937,811$

2011/12/31