Asus 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

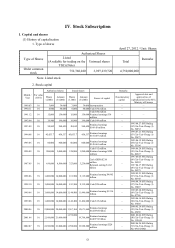

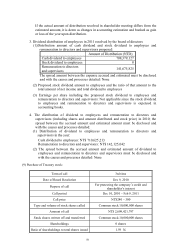

Type of corporate bond The 1st domestic convertible bond

before the due date, if the convertible bond in

circulation is for an amount less than 10% of total

issuance, the company may send a “bond call notice”

(the said period starts from the date of notice sent by

the company; also, the baseline date for “call” is on

the last day of the period; moreover, the baseline date

for “call” may not fall in the no-conversion period o

f

this convertible bond) to creditors (based on the

roster on the fifth working day before sending the

“Bond Call Notice;” however, a notice is published

for the knowledge of investors who have acquired the

convertible bond by trade or other means) by

certified mail. Inform GreTai in writing to have it

published; also, the convertible bonds are “called” at

face value on the due date.

Restrictive clauses -

Rating institute, rating date, corporate

bond rating

-

Other rights

Converted

(exchanged or

subscribed) common

stock, GDR, or

marketable security

up to the date of the

report printed

NT$7,000,000 (up to the date of the report printed)

Issuance &

conversion (exchange

or subscription) Act

Except for periods of (1) the no-conversion period defined by

law (2) from three working days prior to ex-right date for

stock dividend registered with SEC by the company to the

baseline date of equity distribution; from three working days

prior to ex-dividend date for cash capitalization to the

b

aseline date of stock distribution; three working days prior

to cut-off date for cash capitalization to the baseline date o

f

equity distribution; and three working days prior to the

baseline day for merger or stock split to the baseline date,

creditors may request the company to have convertible bonds

converted to the company’s common stock in accordance

with Article 11, Article 12, and Article 17 of this Act at any

time from the 31st day of the issuance date to ten days before

the due date.

ssuance and conversion, exchange or

subscription measures; the influence of

issuance conditions on the dilution of

equity and shareholder’s equity

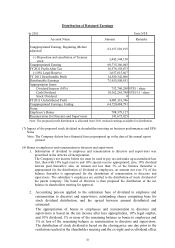

(a)The convertible bond helps avoid profit erosion and

minimize the dilution of shareholder’s equity and ERP

resulted from the substantial increase of stock shares;

therefore, it is to the best interest of shareholders.

(b)Based on the conversion price of NT$105.4, the dilution

of shareholder’s equity caused by the convertible

corporate bond is 3.23%; Nonetheless, the bond was

redeemed on November 7, 2011 and therefore there is

no potential dilution effect or has no effect on

stockholders equity.

Depository institute -