Asus 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

~28~

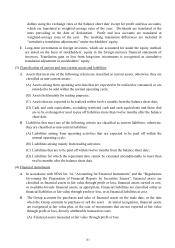

C. When the equity of long-term equity investments under the equity method including unrealized

gain on financial instruments, foreign currency translation adjustments, net loss not recognized

as pension cost, and unrealized losses on cash flow hedges is changed, the changes in

percentage of ownership are reflected in those related accounts and long-term equity

investments under the equity method.

D. Unrealized inter-company profit or loss resulting from transactions between the Group and

investees accounted for under the equity method are accounted in unrealized gain on

inter-affiliate accounts and deferred until realized.

(8) Investment - land use right

Investment - land use right is stated at cost, and amortized using the average method over the

contract period. If an objective evidence of impairment exists and the recovery is remote, an

impairment loss is recognized.

(9) Property, plant and equipment, leased assets and idle assets

A. Property, plant and equipment are stated at cost. Cost associated with significant additions,

improvements, and replacements to property, plant and equipment are capitalized.

Expenditures for regular repairs and maintenance are charged against operating income.

B. Property, plant and equipment leased to other parties under operating leases are classified as

leased assets. The related depreciation is provided under the straight-line method based on the

assets’ estimated useful lives and accounted for as a reduction of rental income. Property, plant

and equipment not currently used in operations are transferred to idle assets. The cost,

accumulated depreciation, and accumulated impairment of the original assets not currently

used in operations are all transferred to idle assets and depreciated.

C. Depreciation is provided under the straight-line method over the estimated useful lives of the

assets. Salvage value of the fully depreciated assets that are still in use is depreciated over the

re-estimated useful lives. The estimated useful lives are 3~60 years for buildings, 2~10 years

for machinery and equipment and 1~20 years for other property, plant and equipment.

(10) Intangible assets and deferred expenses

Intangible assets represent goodwill, trademarks, technology know-how, computer software and

land use rights. Goodwill and intangible assets with indefinite useful lives are subject to tests of

impairment every year, while others are amortized using the straight-line method over their

estimated economic lives. Deferred expenses represent office decoration, molds and fixtures

which are amortized using the straight-line method over 1~5 years.

(11) Impairment of non-financial assets

A. The Group assesses all applicable assets subject to SFAS No. 35 for indication of impairment

at the balance sheet date. If any indication of impairment exists, the Group then compares the

carrying amount with the recoverable amount of the assets or the cash-generating unit (“CGU”)

and writes down the carrying amount to the recoverable amount. If the recoverable amount of

an asset other than goodwill has increased as a result of the increase in its estimated service

potential, the Group reverses the impairment loss to the extent that the carrying amount after

the reversal would not exceed the amount (net of amortization or depreciation) that would