Asus 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

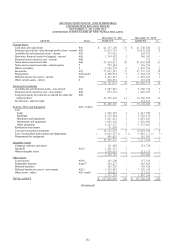

(2) Fair values of the financial instruments

The methods and assumptions used to estimate the fair values of the above financial instruments

are summarized below:

A. The above financial instruments exclude cash and cash equivalents, notes/accounts receivable

(including related parties), other receivables (including related parties), refundable deposits,

notes/accounts payable (including related parties), accrued expenses, dividends payable, other

current liabilities and guarantee deposits received. For such financial instruments, the fair

values were determined based on their carrying values because of the short maturities of the

instruments.

B. The fair values of financial assets at fair value through profit or loss and available-for-sale

financial assets are based on quoted market prices in an active market. If the market for a

financial instrument is not active, an entity establishes fair value by using a valuation

technique. The Company uses estimates and assumptions that are consistent with information

that market participants would use in setting a price for these financial instruments.

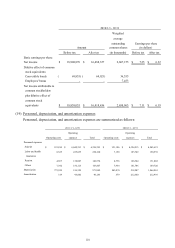

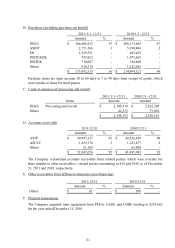

Estimated Estimated

Quotations using a Quotations using a

in an active valuation in an active valuation

Book value market technique Book value market technique

Financial instruments

Non-derivative financial instruments

Assets

Financial assets at fair value

through profit or loss - current

9,715,912$ 9,715,912$ -$ 8,134,394$ 8,134,394$ -$

Available-for-sale financial assets - current 274,792 274,792 - 136,793 136,793 -

Available-for-sale financial assets - non-current 7,068,339 7,068,339 - 6,346,516 6,346,516 -

Financial assets caried at cost - current 372 - - 372 - -

Financial assets caried at cost - non-current 107,579 - - 400,520 - -

Liabilities

Bonds payable (including current portion) - - - 2,412,309 - 2,415,377

Derivative financial instruments

Assets

Financial assets at fair value

through profit or loss - current

Forward exchange contracts 21,391 - 21,391 - - -

Currency options contracts - - - 3,004 - 3,004

Liabilities

Financial liabilities at fair value

through profit or loss - current

Call/put option and conversion right

- bonds payable

- - - 104,525 - 104,525

Forward exchange contracts 32,695 - 32,695 - - -

Currency options contracts - - - 1,370 - 1,370

2011/12/31

2010/12/31

Fair value

Fair value