Asus 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

192

~64~

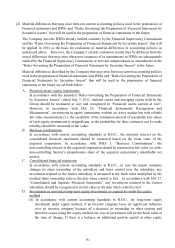

(2) Material differences that may arise between current accounting policies used in the preparation of

financial statements and IFRSs and “Rules Governing the Preparation of Financial Statements by

Securities Issuers” that will be used in the preparation of financial statements in the future:

The Company uses the IFRSs already ratified currently by the Financial Supervisory Commission

and the “Rules Governing the Preparation of Financial Statements by Securities Issuers” that will

be applied in 2013 as the basis for evaluation of material differences in accounting policies as

mentioned above. However, the Company’s current evaluation results may be different from the

actual differences that may arise when new issuances of or amendments to IFRSs are subsequently

ratified by the Financial Supervisory Commission or relevant interpretations or amendments to the

“Rules Governing the Preparation of Financial Statements by Securities Issuers” in the future.

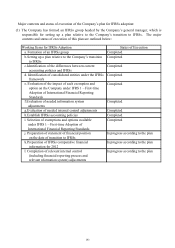

Material differences identified by the Company that may arise between current accounting policies

used in the preparation of financial statements and IFRSs and “Rules Governing the Preparation of

Financial Statements by Securities Issuers” that will be used in the preparation of financial

statements in the future are set forth below:

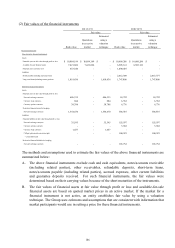

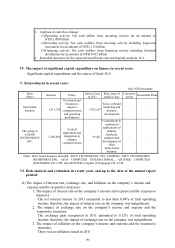

A. Financial assets: equity instruments

In accordance with the amended “Rules Governing the Preparation of Financial Statements

by Securities Issuers”, dated July 7, 2011, unlisted stocks and emerging stocks held by the

Group should be measured at cost and recognized in “Financial assets carried at cost”.

However, in accordance with IAS 39, “Financial Instruments: Recognition and

Measurement”, investments in equity instruments without an active market but with reliable

fair value measurement (i.e. the variability of the estimation interval of reasonable fair values

of such equity instruments is insignificant, or the probability for these estimates can be made

reliably) should be measured at fair value.

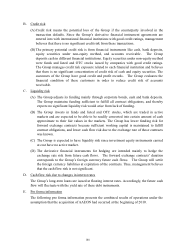

B. Business combinations

In accordance with current accounting standards in R.O.C., the minority interest on the

consolidated financial statements should be measured based on the book value of the

acquired corporation. In accordance with IFRS 3, “Business Combinations”, the

non-controlling interest in the acquired corporation should be measured at fair value (or at the

non-controlling interest’s proportionate share of the acquired corporation’s identifiable net

assets).

C. Consolidated financial statements

In accordance with current accounting standards in R.O.C., in case the parent company

changes its share ownership of the subsidiary and loses control over the subsidiary, any

investment retained in the former subsidiary is measured at the book value multiplied by the

residual share ownership ratio at the date when control is lost. In accordance with IAS 27,

“Consolidated and Separate Financial Statements”, any investment retained in the former

subsidiary should be recognized at its fair value at the date when control is lost.

D. Investments in associates/long-term equity investments accounted for under the equity

method

(A) In accordance with current accounting standards in R.O.C., for long-term equity

investment under equity method, if an investor company loses its significant influence

over an investee company because of a decrease in ownership or other reasons and

therefore ceases using the equity method, the cost of investment will be the book value at

the time of change. If there is a balance on additional paid-in capital or other equity