Asus 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

B. The fair value of non-equity convertible options, put options, call options and resetting options

embedded in bonds payable was separated from bonds payable, and was recognized in

“Financial assets or liabilities at fair value through profit or loss” in accordance with SFAS No.

34.

C. As of December 31, 2011, except for some bonds which had been converted, all bonds of the

Company had matured and been redeemed.

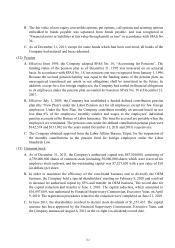

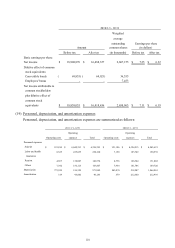

(12) Pension

A. Effective from 1995, the Company adopted SFAS No. 18, “Accounting for Pensions”. The

funding status of the pension plan as of December 31, 1995 was measured on an actuarial

basis. In accordance with SFAS No. 18, net pension cost was recognized from January 1, 1996.

Because the accrued pension liability was equal to the funding status of the pension plan, no

unrecognized transitional net assets or net obligations shall be amortized in the future. In

addition, except for a few foreign employees, the Company had settled its financial obligations

to its employees under the pension plan accounted for based on SFAS No. 18 at December 31,

2007.

B. Effective July 1, 2005, the Company has established a funded defined contribution pension

plan (the “New Plan”) under the Labor Pension Act for all employees except for few foreign

employees. Under the New Plan, the Company contributes monthly an amount based on not

less than 6% of the employees’ monthly salaries and wages to the employees’ individual

pension accounts at the Bureau of Labor Insurance. The benefits accrued are portable when the

employees are terminated. The pension costs under the defined contribution pension plan were

$142,574 and $131,082 for the years ended December 31, 2011 and 2010, respectively.

C. The Company obtained approval from the Labor Affairs Bureau, Taipei, for the suspension of

the monthly contributions to the pension fund for foreign employees under the Labor

Standards Law.

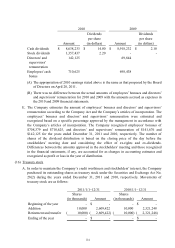

(13) Common stock

A. As of December 31, 2011, the Company’s authorized capital was $47,500,000, consisting of

4,750,000,000 shares of common stock (including 50,000,000 shares which were reserved for

employee stock options), and the outstanding capital was $7,527,603 with a par value of $10

(in dollars) per share.

B. In order to maximize the efficiency of the own-brand business and to diversify the OEM

business, the Company held a special shareholders’ meeting on February 9, 2010 and resolved

to decrease its authorized capital by 85% and transfer its OEM business. The record date for

the capital reduction and transfer is June 1, 2010. The capital reduction, which amounted to

$36,097,609, was authorized by Financial Supervisory Commission, Executive Yuan, on April

9, 2010. The registration procedures related to the reduction were completed on June 21, 2010.

C. In June 2011, the shareholders resolved to declare stock dividends of $1,357,437. The capital

increase has been approved by the Financial Supervisory Commission, Executive Yuan, and

the Company announced August 6, 2011 as the ex-right (ex-dividend) record date.