Asus 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

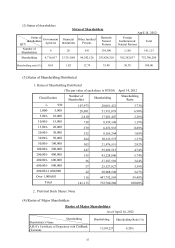

58

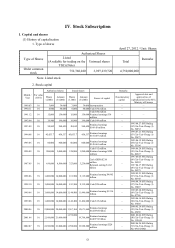

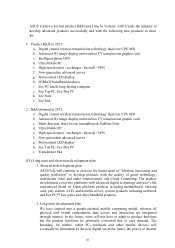

Distribution of Retained Earnings

In 2011 Unit: NT$

Account Name Amount Remarks

Unappropriated Earning, Beginning (Before

adjusted) 63,157,510,195

(-) Disposition and cancellation of Treasury

stock 2,442,344,150

Unappropriated Earning 60,715,166,045

FY2011 Profit After Tax 16,578,158,673

(-)10% Legal Reserve 1,657,815,867

FY 2011 Distributable Profit 14,920,342,806

Distributable Earnings 75,635,508,851

Appropriation Items:

Dividend Interest (10%) 752,760,280 NT$1 / share

Cash Dividend 10,162,263,780 NT$13.5 / share

Stock Dividend 0

FY2011 Undistributed Profit 4,005,318,746

Unappropriated Earnings, Ending 64,720,484,791

Notes:

Employee’s Bonus 708,379,127

Remuneration for Directors and Supervisors 141,675,825

Note: The proposed profit distribution is allocated from 2011 retained earnings available for distribution.

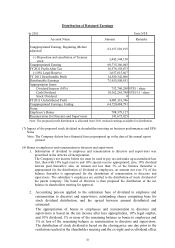

(7) Impact of the proposed stock dividend in shareholders meeting on business performances and EPS:

None

Note: The Company did not have financial forecast proposed up to the date of the annual report

printed.

(8) Bonus to employees and remuneration to directors and supervisors

1. Information of dividend to employee and remuneration to directors and supervisors was

prescribed in the Articles of Incorporation.

The Company's net income before tax must be used to pay tax and make up accumulated loss

first, then with 10% legal reserve and 10% special reserve appropriated; also, 10% dividend

interest paid thereafter; also, an amount not less than 1% of the balance thereafter is

appropriated for the distribution of dividend to employees, an amount not over 1% of the

balance thereafter is appropriated for the distribution of remuneration to directors and

supervisors. The subsidiary’s employees are entitled to the distribution of stock dividend of

the parent company. The board of directors is then proposed the distribution of the net

balance in shareholders meeting for approval.

2. Accounting process applied to the estimation base of dividend to employee and

remuneration to directors and supervisors, outstanding shares computing base for

stock dividend distribution, and the spread between amount distributed and

estimated:

The appropriation of bonus to employees and remuneration to directors and

supervisors is based on the net income after loss appropriation, 10% legal surplus,

and 10% dividend; 1% or more of the remaining balance as bonus to employees and

1% or less of the remaining balance as remuneration to directors and supervisors.

The distribution of stock dividend is based on the closing price one day prior to the

resolution reached in the shareholder meeting and the ex-right and ex-dividend effect.