Asus 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

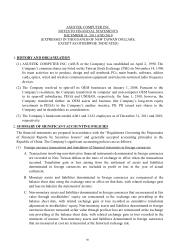

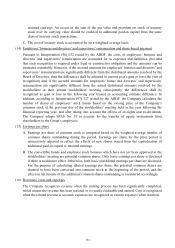

(17) Use of estimates

The preparation of financial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the amounts of

assets and liabilities and the disclosures of contingent assets and liabilities at the date of the

financial statements and the amounts of revenues and expenses during the reporting period.

Actual results could differ from those assumptions and estimates.

(18) Spin-off transaction

The Company resolved to spin off its OEM assets and businesses. The Company adopted

Interpretations (91) 128, (92) 106 and (92) 107 issued by the ARDF to account for its spin-off

transactions. Since the transferee company continues the transferor company’s economic activities,

the Company did not record any gain or loss from the said spin-off transaction but has adjusted

the net assets and long-term equity investment related additional paid-in capital and other equity

account against retained earnings or other components.

(19) Operating segments

In accordance with SFAS No. 41, “Segment reporting”, operating segments are reported in a

manner consistent with the internal reporting provided to the chief operating decision-maker.

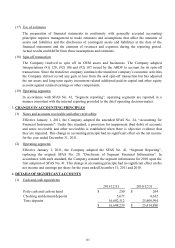

3. CHANGES IN ACCOUNTING PRINCIPLES

(1) Notes and accounts receivable and other receivables

Effective January 1, 2011, the Company adopted the amended SFAS No. 34, “Accounting for

Financial Instruments”. Under this standard, a provision for impairment (bad debt) of accounts

and notes receivable and other receivables is established when there is objective evidence that

they are impaired. This change in accounting principle had no significant effect on the net income

for the year ended December 31, 2011.

(2) Operating segments

Effective January 1, 2011, the Company adopted the SFAS No. 41, “Segment Reporting”,

replacing the original SFAS No. 20, “Disclosure of Segment Financial Information”. In

accordance with such standard, the Company restated the segment information for 2010 upon the

first adoption of SFAS No. 41. This change in accounting principle had no significant effect on the

net income and earnings per share for the years ended December 31, 2011 and 2010.

4. DETAILS OF SIGNIFICANT ACCOUNTS

(1) Cash and cash equivalents

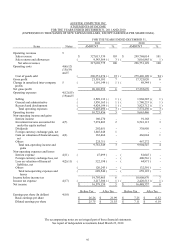

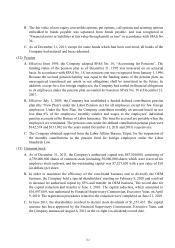

2011/12/31 2010/12/31

Petty cash and cash on hand 250$ 264$

Checking and demand deposits 5,677 4,632

Time deposits 16,602,312 25,409,994

16,608,239$ 25,414,890$