Asus 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

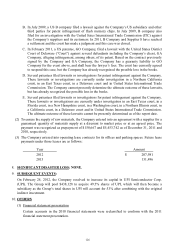

B. In July 2009, a US B company filed a lawsuit against the Company’s US subsidiary and other

third parties for patent infringement of flash memory chips. In July 2009, B company also

filed for an investigation with the United Sates International Trade Commission (ITC) against

the Company’s suppliers and its customers. In 2011, B Company and Supplier S have reached

a settlement and the court has made a judgment and this case was closed.

C. In February 2011, a US patentee, GO Company, filed a lawsuit with the United States District

Court of Delaware (“Court”) against several defendants including the Company’s client, GA

Company, alleging infringement, among others, of its patent. Based on the contract previously

signed by the Company and GA Company, the Company has a guaranty liability to GO

Company for the event above, and shall bear the lawyer’s fees. The court has currently agreed

to suspend this case, but the Company has already recognized the possible loss in the books.

D. Several patentees filed lawsuits or investigations for patent infringement against the Company.

These lawsuits or investigations are currently under investigation in a Northern California

court, in an East Texas court, in a Delaware court and in United States International Trade

Commission. The Company cannot presently determine the ultimate outcome of these lawsuits,

but has already recognized the possible loss in the books.

E. Several patentees filed lawsuits or investigations for patent infringement against the Company.

These lawsuits or investigations are currently under investigation in an East Texas court, in a

Florida court, in a New Hampshire court, in a Washington court, in a Northern Illinois court, in

a California court, in a Delaware court and in United States International Trade Commission.

The ultimate outcome of these lawsuits cannot be presently determined as of the report date.

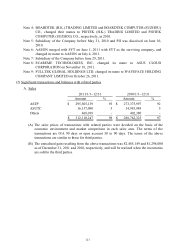

(2) To ensure the supply of raw materials, the Company entered into an agreement with a supplier for a

guaranteed quantity of materials supply at a discount to market price or at an agreed price. The

payment was recognized as prepayment of $150,667 and $5,453,742 as of December 31, 2011 and

2010, respectively.

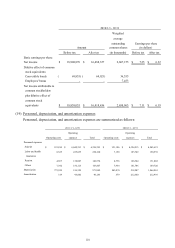

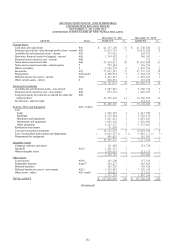

(3) The Company entered into operating lease contracts for its offices and parking spaces. Future lease

payments under those leases are as follows:

8. SIGNIFICANT DISASTER LOSS: NONE.

9. SUBSEQUENT EVENTS:

On February 24, 2012, the Company resolved to increase its capital in UPI Semiconductor Corp.

(UPI). The Group will pool $438,128 to acquire 49.5% shares of UPI, which will then become a

subsidiary as the Group’s total shares in UPI will account for 53% after combining with the original

indirect investment.

10. OTHERS

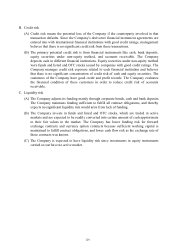

(1) Financial statement presentation

Certain accounts in the 2010 financial statements were reclassified to conform with the 2011

financial statement presentation.

Year

Amount

2012

207,981$

2013

131,496