Asus 2011 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

193

~65~

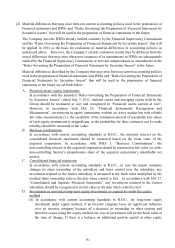

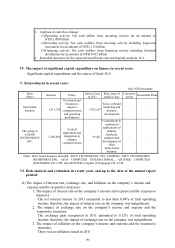

adjustment items from the long-term equity investment, then an investor company shall

calculate its share when the investment is sold, so that the pro-rata gains or losses from

the disposal of the long-term investment can be accounted for. In accordance with IAS 28,

“Investments in Associates”, when an investment ceases to be an associate, the fair value

of the remaining investment at the date when it ceases to be an associate should be

regarded as its fair value on initial recognition of the financial asset. If there is a

balance on additional paid-in capital or other equity adjustment items from the long-term

equity investment, it shall be written off totally by the investor company when the

investment is sold, so that the gains or losses from the disposal of the long-term

investment can be accounted for.

(B) In accordance with current accounting standards in R.O.C., if an investee company issues

new shares and original shareholders do not purchase or acquire new shares

proportionately, but the investor company does not lose its significant influence over the

investee company, the investment percentage, and therefore the equity in net assets for

the investment that an investor company has invested, will be changed. Such difference

shall be used to adjust the ‘Additional paid-in capital’ and the ‘Long-term equity

investments’ accounts. However, in accordance with IAS 28, “Investments in

Associates”, an increase in investment percentage is accounted for as an acquisition of

investment; while, a decrease in investment percentage is accounted for as a disposal of

investment and any related disposal gain or loss is recognized.

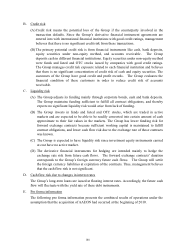

E. Employee benefits

The current accounting standards in R.O.C. do not specify the rules on the cost recognition

for accumulating compensated absences. The Company recognizes such costs as expenses

upon actual payment. However, IAS 19, “Employee Benefits”, requires that the costs of

accumulating compensated absences should be accrued as expenses at the end of the

reporting period.

F. Income taxes

(A) In accordance with current accounting standards in R.O.C., a deferred tax asset or liability

should, according to the classification of its related asset or liability, be classified as

current or noncurrent. However, a deferred tax asset or liability that is not related to an

asset or liability for financial reporting, should be classified as current or noncurrent

according to the expected time period to realize or settle a deferred tax asset or liability.

However, under IAS 1, “Presentation of Financial Statements”, an entity should not

classify a deferred tax asset or liability as current.

(B) The current accounting standards in R.O.C do not specify the rules on the tax rate that

shall apply to the deferred tax assets or liabilities associated with unrealized gain or loss

arising from transactions between parent company and subsidiaries. The Company

adopts the seller’s tax rate to recognize such deferred tax. However, under IAS 12,

“Income Taxes”, temporary differences in the consolidated financial statements are

determined by comparing the carrying amounts of assets and liabilities in the financial

statements and applicable taxation basis. As the Company’s tax base is determined by

reference to the Group entities’ income tax returns, the buyer’s tax rate shall apply to the

deferred tax associated with unrealized gain or loss arising from transactions between

parent company and subsidiaries.