Asus 2011 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2011 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153

~25~

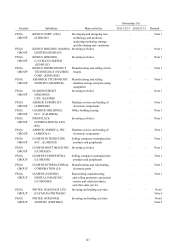

dollars using the exchange rates at the balance sheet date except for profit and loss accounts,

which are translated at weighted-average rates of the year. Dividends are translated at the

rates prevailing at the date of declaration. Profit and loss accounts are translated at

weighted-average rates of the year. The resulting translation differences are included in

“cumulative translation adjustments” under stockholders’ equity.

E. Long-term investments in foreign investees, which are accounted for under the equity method,

are stated on the basis of stockholders’ equity in the foreign-currency financial statements of

investees. Translation gain or loss from long-term investments is recognized as cumulative

translation adjustment in stockholders’ equity.

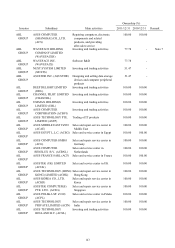

(3) Classification of current and non-current assets and liabilities

A. Assets that meet one of the following criteria are classified as current assets; otherwise, they are

classified as non-current assets:

(A) Assets arising from operating activities that are expected to be realized or consumed, or are

intended to be sold within the normal operating cycle;

(B) Assets held mainly for trading purposes;

(C) Assets that are expected to be realized within twelve months from the balance sheet date;

(D) Cash and cash equivalents, excluding restricted cash and cash equivalents and those that

are to be exchanged or used to pay off liabilities more than twelve months after the balance

sheet date.

B. Liabilities that meet one of the following criteria are classified as current liabilities; otherwise,

they are classified as non-current liabilities:

(A) Liabilities arising from operating activities that are expected to be paid off within the

normal operating cycle;

(B) Liabilities arising mainly from trading activities;

(C) Liabilities that are to be paid off within twelve months from the balance sheet date;

(D) Liabilities for which the repayment date cannot be extended unconditionally to more than

twelve months after the balance sheet date.

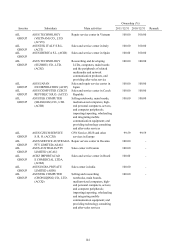

(4) Financial instruments

A. In accordance with SFAS No. 34, “Accounting for Financial Instruments” and the “Regulations

Governing the Preparation of Financial Reports by Securities Issuers”, financial assets are

classified as financial assets at fair value through profit or loss, financial assets carried at cost,

or available-for-sale financial assets, as appropriate. Financial liabilities are classified either as

financial liabilities at fair value through profit or loss, or as financial liabilities at cost.

B. The Group accounts for purchases and sales of financial assets on the trade date, or the date

when the Group commits to purchase or sell the asset. At initial recognition, financial assets

are recognized at fair value plus, in the case of investments that are not reported at fair value

through profit or loss, directly attributable transaction costs.

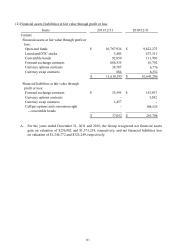

(A) Financial assets measured at fair value through profit or loss