APS 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

Table of Contents

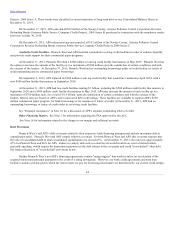

Regulatory Accounting

Regulatory accounting allows for the actions of regulators, such as the ACC and FERC, to be reflected in our financial

statements. Their actions may cause us to capitalize costs that would otherwise be included as an expense in the current period by

unregulated companies. Regulatory assets represent incurred costs that have been deferred because they are probable of future

recovery in customer rates. Regulatory liabilities generally represent expected future costs that have already been collected from

customers. Management continually assesses whether our regulatory assets are probable of future recovery by considering factors such

as applicable regulatory environment changes and recent rate orders to other regulated entities in the same jurisdiction. This

determination reflects the current political and regulatory climate in Arizona and is subject to change in the future. If future recovery of

costs ceases to be probable, the assets would be written off as a charge in current period earnings. We had $1,364 million of regulatory

assets and $1,140 million of regulatory liabilities on the Consolidated Balance Sheets at December 31, 2015.

Included in the balance of regulatory assets at December 31, 2015 is a regulatory asset of $619 million for pension benefits.

This regulatory asset represents the future recovery of these costs through retail rates as these amounts are charged to earnings. If these

costs are disallowed by the ACC, this regulatory asset would be charged to OCI and result in lower future earnings.

See Notes 1 and 3 for more information.

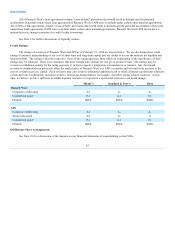

Pensions and Other Postretirement Benefit Accounting

Changes in our actuarial assumptions used in calculating our pension and other postretirement benefit liability and expense can

have a significant impact on our earnings and financial position. The most relevant actuarial assumptions are the discount rate used to

measure our liability and net periodic cost, the expected long-term rate of return on plan assets used to estimate earnings on invested

funds over the long-term, the mortality assumptions, and the assumed healthcare cost trend rates. We review these assumptions on an

annual basis and adjust them as necessary.

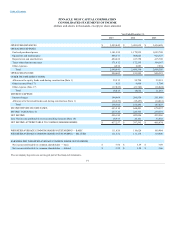

The following chart reflects the sensitivities that a change in certain actuarial assumptions would have had on the December 31,

2015 reported pension liability on the Consolidated Balance Sheets and our 2015 reported pension expense, after consideration of

amounts capitalized or billed to electric plant participants, on Pinnacle West’s Consolidated Statements of Income (dollars in millions):

Increase (Decrease)

Actuarial Assumption (a)

Impact on

Pension

Liability

Impact on

Pension

Expense

Discount rate:

Increase 1%

$ (329)

$ (11)

Decrease 1%

399

16

Expected long-term rate of return on plan assets:

Increase 1%

—

(13)

Decrease 1%

—

13

(a) Each fluctuation assumes that the other assumptions of the calculation are held constant while the rates are changed by one

percentage point.

67