APS 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

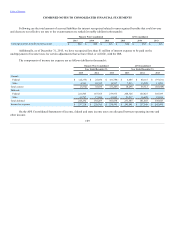

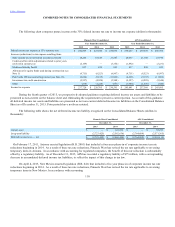

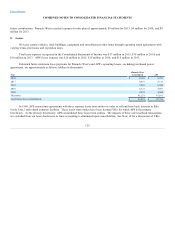

compliance with this common equity ratio requirement. Its total shareholder equity was approximately $4.7 billion, and total

capitalization was approximately $8.6 billion. APS would be prohibited from paying dividends if the payment would reduce its total

shareholder equity below approximately $3.4 billion, assuming APS’s total capitalization remains the same. Since APS was in

compliance with this common equity ratio requirement, this restriction does not materially affect Pinnacle West’s ability to meet its

ongoing capital requirements.

Although provisions in APS’s articles of incorporation and ACC financing orders establish maximum amounts of preferred

stock and debt that APS may issue, APS does not expect any of these provisions to limit its ability to meet its capital requirements. On

February 6, 2013, the ACC issued a financing order in which, subject to specified parameters and procedures, it approved an increase

in APS’s long-term debt authorization from $4.2 billion to $5.1 billion in light of the projected growth of APS and its customer base and

the resulting projected financing needs, and authorized APS to enter into derivative financial instruments for the purpose of managing

interest rate risk associated with its long- and short-term debt. This financing order is set to expire on December 31, 2017. See Note 5

for additional short-term debt provisions.

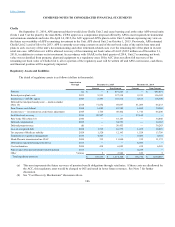

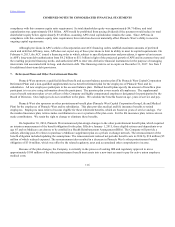

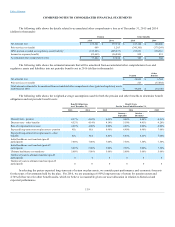

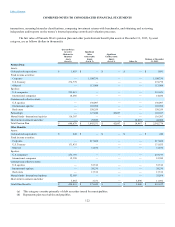

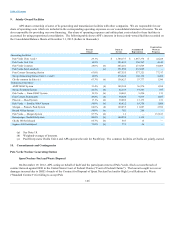

7. Retirement Plans and Other Postretirement Benefits

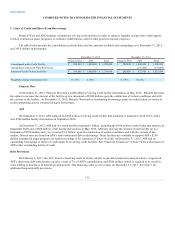

Pinnacle West sponsors a qualified defined benefit and account balance pension plan (The Pinnacle West Capital Corporation

Retirement Plan) and a non-qualified supplemental excess benefit retirement plan for the employees of Pinnacle West and its

subsidiaries. All new employees participate in the account balance plan. Defined benefit plans specify the amount of benefits a plan

participant is to receive using information about the participant. The pension plan covers nearly all employees. The supplemental

excess benefit retirement plan covers officers of the Company and highly compensated employees designated for participation by the

Board of Directors. Our employees do not contribute to the plans. We calculate the benefits based on age, years of service and pay.

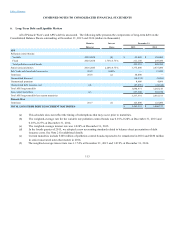

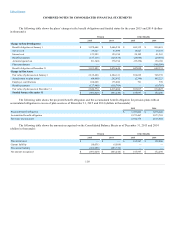

Pinnacle West also sponsors an other postretirement benefit plan (Pinnacle West Capital Corporation Group Life and Medical

Plan) for the employees of Pinnacle West and its subsidiaries. This plan provides medical and life insurance benefits to retired

employees. Employees must retire to become eligible for these retirement benefits, which are based on years of service and age. For

the medical insurance plan, retirees make contributions to cover a portion of the plan costs. For the life insurance plan, retirees do not

make contributions. We retain the right to change or eliminate these benefits.

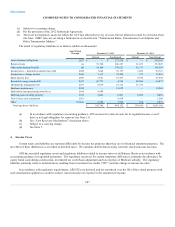

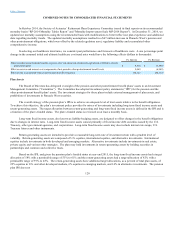

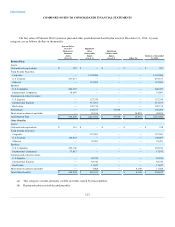

On September 30, 2014, Pinnacle West announced plan design changes to the other postretirement benefit plan, which required

an interim remeasurement of the benefit obligation for the plan. Effective January 1, 2015, those eligible retirees and dependents over

age 65 and on Medicare can choose to be enrolled in a Health Reimbursement Arrangement (HRA). The Company will provide a

subsidy allowing post-65 retirees to purchase a Medicare supplement plan on a private exchange network. The remeasurement of the

benefit obligation included updating the assumptions. The remeasurement reduced net periodic benefit costs in 2014 by $10 million ($5

million of which reduced expense). The remeasurement also resulted in a decrease in Pinnacle West’s other postretirement benefit

obligation of $316 million, which was offset by the related regulatory asset and accumulated other comprehensive income.

Because of the plan changes, the Company is currently in the process of seeking IRS and regulatory approval to move

approximately $100 million of the other postretirement benefit trust assets into a new trust account to pay for active union employee

medical costs.

116