APS 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Our investments in the nuclear decommissioning trust fund are accounted for in accordance with guidance on accounting for

certain investments in debt and equity securities. See Note 13 and Note 19 for more information on these investments.

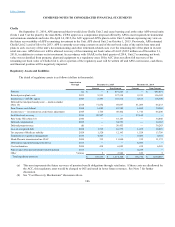

Business Segments

Pinnacle West’s reportable business segment is our regulated electricity segment, which consists of traditional regulated retail

and wholesale electricity businesses (primarily electricity service to Native Load customers) and related activities and includes

electricity generation, transmission and distribution. All other segment activities are insignificant.

Preferred Stock

At December 31, 2015, Pinnacle West had 10 million shares of serial preferred stock authorized with no par value, none of

which was outstanding, and APS had 15,535,000 shares of various types of preferred stock authorized with $25, $50 and $100 par

values, none of which was outstanding.

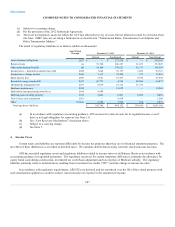

2. New Accounting Standards

In May 2014, new revenue recognition guidance was issued. This guidance provides a single comprehensive model for entities

to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance. The

new revenue standard will be effective for us on January 1, 2018. The guidance may be adopted using a full retrospective application

or a simplified transition method that allows entities to record a cumulative effect adjustment in retained earnings at the date of initial

application. We are currently evaluating this new guidance and the impacts it may have on our financial statements.

In February 2015, new consolidation accounting guidance was issued that amends many aspects of the guidance relating to the

analysis and consolidation of variable interest entities. The new guidance is effective for us, and will be adopted, during the first

quarter of 2016; and may be adopted using either a full retrospective or modified retrospective approach. We do not expect the

adoption of this guidance to have a material impact on our financial statements.

In January 2016, new guidance was issued relating to the recognition and measurement of financial instruments. The amended

guidance will require certain investments in equity securities to be measured at fair value with changes in fair value recognized in net

income, and modifies the impairment assessment of certain equity securities. The new guidance is effective for us on January 1, 2018.

Certain aspects of the guidance may require a cumulative-effect adjustment and other aspects of the guidance are required to be

adopted prospectively. We are currently evaluating this new accounting standard and the impacts it may have on our financial

statements.

During the fourth quarter of 2015 we elected to early adopt the following accounting standard updates:

• Balance sheet presentation of deferred income taxes. See Note 4.

• Balance sheet presentation of debt issuance costs: Adopted on a retrospective basis, the new guidance requires debt issuance

costs to be presented on the balance sheets as a direct reduction to the related debt liabilities. Prior to the adoption of this

guidance we were required to present debt issuance costs as an asset on the balance sheets. As a result of adopting this

guidance, our December 31, 2015 Consolidated Balance Sheet includes $28 million of debt issuance costs as a reduction to our

long-term

98