APS 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

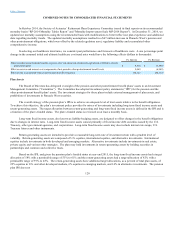

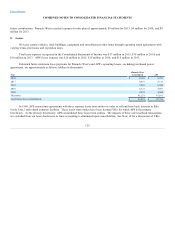

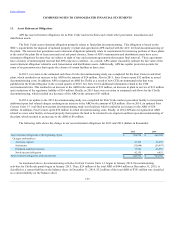

Verde's spent nuclear fuel and high level waste from January 1, 2007 through June 30, 2011, as it was required to do pursuant to the

terms of the Standard Contract and the Nuclear Waste Policy Act. On August 18, 2014, APS and DOE entered into a settlement

agreement, stipulating to a dismissal of the lawsuit and payment of $57.4 million by DOE to the Palo Verde owners for certain specified

costs incurred by Palo Verde during the period January 1, 2007 through June 30, 2011. APS’s share of this amount is $16.7 million.

Amounts recovered in the lawsuit and settlement were recorded as adjustments to a regulatory liability and had no impact on the

amount of current reported net income. In addition, the settlement agreement provides APS with a method for submitting claims and

getting recovery for costs incurred through 2016.

APS’s first claim made pursuant to the terms of the August 18, 2014 settlement agreement, which was for the period July 1,

2011 through June 30, 2014, and was for $42.0 million (APS’s share of this amount was $12.2 million), was received on June 1,

2015. APS's $12.2 million share was recorded as an adjustment to a regulatory liability and had no impact on the amount of current

reported net income. APS’s second claim made pursuant to the terms of the August 18, 2014 settlement agreement, which was for the

period July 1, 2014 through June 30, 2015, was filed for $12.0 million (APS's share of this amount would be $3.6 million), and has

been submitted to, but not yet approved by, the DOE in the fourth quarter of 2015.

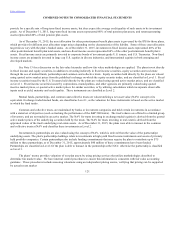

Nuclear Insurance

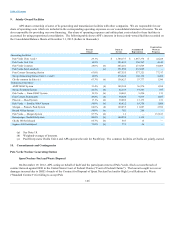

Public liability for incidents at nuclear power plants is governed by the Price-Anderson Nuclear Industries Indemnity Act

(“Price-Anderson Act”), which limits the liability of nuclear reactor owners to the amount of insurance available from both commercial

sources and an industry retrospective payment plan. In accordance with the Price-Anderson Act, the Palo Verde participants are

insured against public liability for a nuclear incident up to $13.5 billion per occurrence. Palo Verde maintains the maximum available

nuclear liability insurance in the amount of $375 million, which is provided by American Nuclear Insurers ("ANI"). The remaining

balance of $13.1 billion of liability coverage is provided through a mandatory industry-wide retrospective assessment program. If

losses at any nuclear power plant covered by the program exceed the accumulated funds, APS could be assessed retrospective premium

adjustments. The maximum retrospective premium assessment per reactor under the program for each nuclear liability incident is

approximately $127.3 million, subject to an annual limit of $19 million per incident, to be periodically adjusted for inflation. Based on

APS’s ownership interest in the three Palo Verde units, APS’s maximum potential retrospective premium assessment per incident for all

three units is approximately $111 million, with a maximum annual retrospective premium assessment of approximately $16.6 million.

The Palo Verde participants maintain “all risk” (including nuclear hazards) insurance for property damage to, and

decontamination of, property at Palo Verde in the aggregate amount of $2.8 billion, a substantial portion of which must first be applied

to stabilization and decontamination. APS has also secured insurance against portions of any increased cost of replacement generation

or purchased power and business interruption resulting from a sudden and unforeseen accidental outage of any of the three units. The

property damage, decontamination, and replacement power coverages are provided by Nuclear Electric Insurance Limited (“NEIL”).

APS is subject to retrospective premium assessments under all NEIL policies if NEIL’s losses in any policy year exceed accumulated

funds. The maximum amount APS could incur under the current NEIL policies totals approximately $23.1 million for each

retrospective premium assessment declared by NEIL’s Board of Directors due to losses. In addition, NEIL policies contain rating

triggers that would result in APS providing approximately $61.7 million of collateral assurance within 20 business days of a rating

downgrade to non-investment grade. The insurance coverage discussed in this and the previous paragraph is subject to certain policy

conditions, sublimits and exclusions.

127