APS 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. Asset Retirement Obligations

APS has asset retirement obligations for its Palo Verde nuclear facilities and certain other generation, transmission and

distribution assets.

The Palo Verde asset retirement obligation primarily relates to final plant decommissioning. This obligation is based on the

NRC’s requirements for disposal of radiated property or plant and agreements APS reached with the ACC for final decommissioning of

the plant. The non-nuclear generation asset retirement obligations primarily relate to requirements for removing portions of those plants

at the end of the plant life or lease term and coal ash pond closures. Some of APS’s transmission and distribution assets have asset

retirement obligations because they are subject to right of way and easement agreements that require final removal. These agreements

have a history of uninterrupted renewal that APS expects to continue. As a result, APS cannot reasonably estimate the fair value of the

asset retirement obligation related to such transmission and distribution assets. Additionally, APS has aquifer protection permits for

some of its generation sites that require the closure of certain facilities at those sites.

In 2015, a revision to the estimated cash flows for the decommissioning study was completed for the Four Corners coal-fired

plant, which resulted in an increase to the ARO in the amount of $24 million. Also in 2015, Four Corners spent $32 million in actual

decommissioning costs. In addition, APS recognized an ARO for Cholla as a result of new CCR environmental rules that were

published in the Federal Register in the second quarter of 2015. See Note 10 for additional information related to the CCR

environmental rules. This resulted in an increase to the ARO in the amount of $39 million, an increase in plant in service of $23 million

and a reduction of the regulatory liability of $16 million. Finally, in 2015 there was a revision in estimated cash flows for the Cholla

decommissioning, which resulted in a decrease of the ARO in the amount of $3 million.

In 2014, an update to the 2013 decommissioning study was completed for Palo Verde nuclear generation facility to incorporate

additional spent fuel related charges resulting in an increase to the ARO in the amount of $20 million. Also in 2014, an updated Four

Corners Units 1-3 coal-fired power plant decommissioning study was finalized, which resulted in an increase to the ARO of $24

million. In addition, Four Corners spent $30 million in actual decommissioning costs. Finally, in 2014 APS also recognized an ARO

related to a new solar facility on leased property that requires the land to be returned to its original condition upon decommissioning of

the plant, which resulted in an increase to the ARO of $6 million.

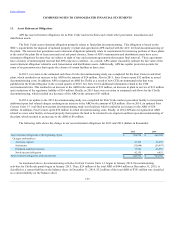

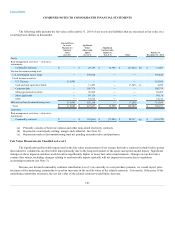

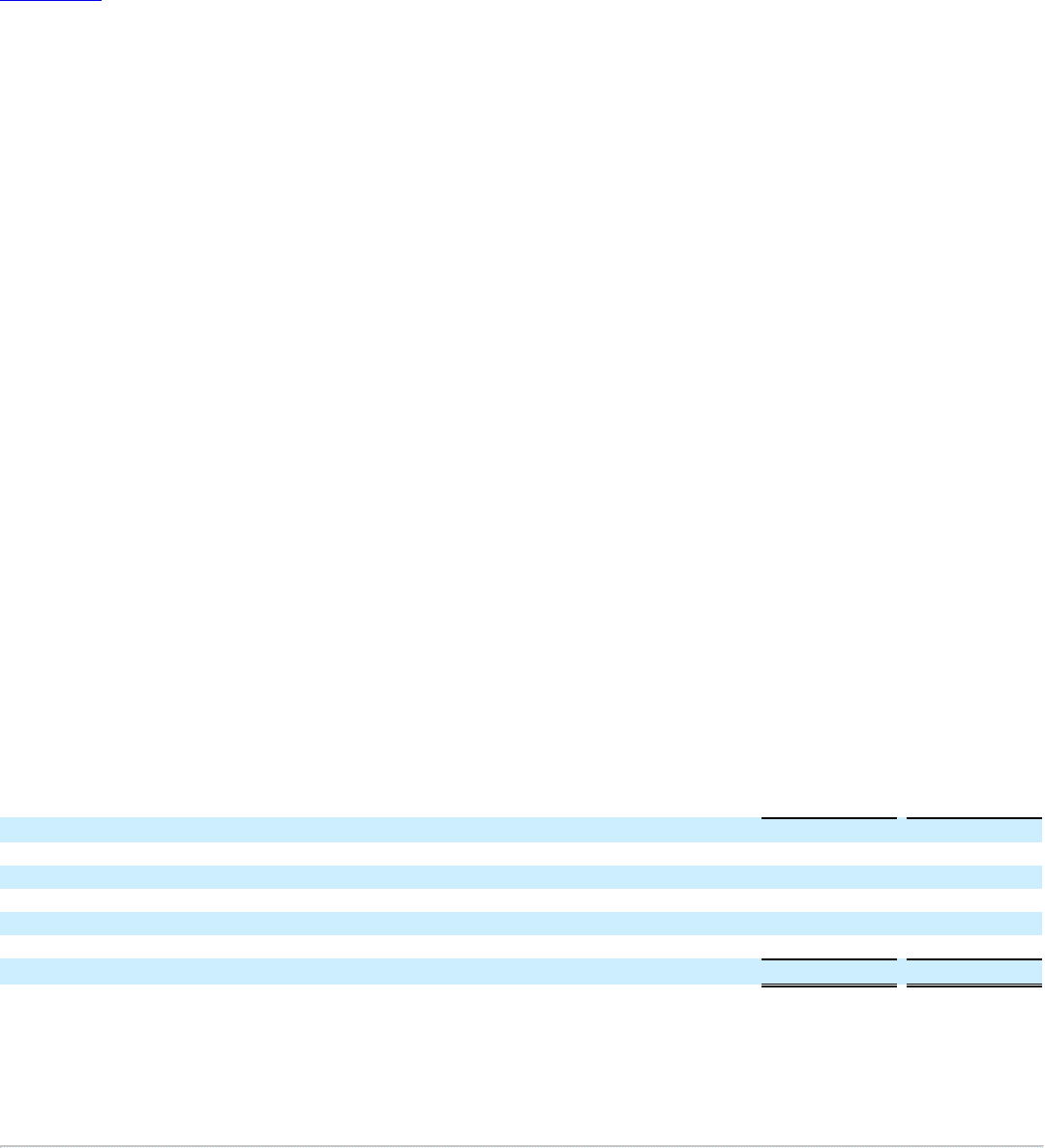

The following table shows the change in our asset retirement obligations for 2015 and 2014 (dollars in thousands):

2015

2014

Asset retirement obligations at the beginning of year $ 390,750

$ 346,729

Changes attributable to:

Accretion expense 25,163

23,567

Settlements (32,048)

(29,497)

Estimated cash flow revisions 17,556

43,899

Newly incurred obligation 42,155

6,052

Asset retirement obligations at the end of year $ 443,576

$ 390,750

As mentioned above, decommissioning activities for Four Corners Units 1-3 began in January 2014. Decommissioning

activities for Cholla ash ponds began in January 2015. Thus, $29 million of the total ARO of $444 million at December 31, 2015, is

classified as a current liability on the balance sheet. At December 31, 2014, $32 million of the total ARO of $391 million was classified

as a current liability on the balance sheet.

135