APS 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Net Metering. On July 12, 2013, APS filed an application with the ACC proposing a solution to address the cost shift

brought by the current net metering rules. On December 3, 2013, the ACC issued its order on APS’s net metering proposal. The ACC

instituted a charge on customers who install rooftop solar panels after December 31, 2013. The charge of $0.70 per kilowatt became

effective on January 1, 2014, and is estimated to collect $4.90 per month from a typical future rooftop solar customer to help pay for

their use of the electric grid. The fixed charge does not increase APS's revenue because it is credited to the LFCR.

In making its decision, the ACC determined that the current net metering program creates a cost shift, causing non-solar utility

customers to pay higher rates to cover the costs of maintaining the electric grid. The ACC acknowledged that the $0.70 per kilowatt

charge addresses only a portion of the cost shift.

On October 20, 2015, the ACC voted to conduct a generic evidentiary hearing on the value and cost of distributed generation to

gather information that will inform the ACC on net metering issues and cost of service studies in upcoming utility rate cases. A hearing

has been scheduled to commence in April 2016. APS cannot predict the outcome of this proceeding.

In 2015, Arizona jurisdictional utilities UNS Electric, Inc. and Tucson Electric Power Company both filed applications with the

ACC requesting rate increases. These applications include rate design changes to mitigate the cost shift caused by net metering. On

December 9, 2015, APS filed testimony in the UNS Electric, Inc. rate case in support of the UNS Electric, Inc. proposed rate design

changes. APS has also requested intervention in the upcoming Tucson Electric Power Company rate case. The outcomes of these

proceedings will not directly impact our financial position.

Appellate Review of Third-Party Regulatory Decision ("System Improvement Benefits" or "SIB"). In a recent appellate

challenge to an ACC rate decision involving a water company, the Arizona Court of Appeals considered the question of how the ACC

should determine the “fair value” of a utility’s property, as specified in the Arizona Constitution, in connection with authorizing the

recovery of costs through rate adjustors outside of a rate case. The Court of Appeals reversed the ACC’s method of finding fair value

in that case, and raised questions concerning the relationship between the need for fair value findings and the recovery of capital and

certain other utility costs through adjustors. The ACC sought review by the Arizona Supreme Court of this decision and APS filed a

brief supporting the ACC’s petition to the Arizona Supreme Court for review of the Court of Appeals’ decision. On February 9, 2016,

the Arizona Supreme Court granted review of the decision and oral argument is set for March 22, 2016. If the decision is upheld by

the Supreme Court without modification, certain APS rate adjustors may require modification. This could in turn have an impact on

APS’s ability to recover certain costs in between rate cases. APS cannot predict the outcome of this matter.

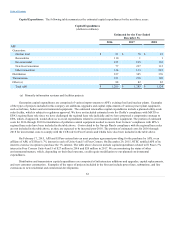

Financial Strength and Flexibility. Pinnacle West and APS currently have ample borrowing capacity under their respective

credit facilities, and may readily access these facilities ensuring adequate liquidity for each company. Capital expenditures will be

funded with internally generated cash and external financings, which may include issuances of long-term debt and Pinnacle West

common stock.

Other Subsidiaries.

Bright Canyon Energy. On July 31, 2014, Pinnacle West announced its creation of a wholly-owned subsidiary, BCE. BCE will

focus on new growth opportunities that leverage the Company’s core expertise in the electric energy industry. BCE’s first initiative is a

50/50 joint venture with BHE U.S. Transmission LLC, a subsidiary of Berkshire Hathaway Energy Company. The joint venture, named

TransCanyon, is pursuing independent transmission opportunities within the eleven states that comprise the Western Electricity

Coordinating Council, excluding opportunities related to transmission service that would otherwise be provided under the tariffs of the

retail service territories of the venture partners’ utility affiliates. TransCanyon

53