APS 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The ownership and operation of power generation and transmission facilities on Indian lands could result in uncertainty related to

continued leases, easements and rights-of-way, which could have a significant impact on our business.

Certain APS power plants and portions of the transmission lines that carry power from these plants are located on Indian lands

pursuant to leases, easements or other rights-of-way that are effective for specified periods. APS is unable to predict the final outcome

of pending and future approvals by applicable governing bodies with respect to renewals of these leases, easements and rights-of-way.

There are inherent risks in the ownership and operation of nuclear facilities, such as environmental, health, fuel supply, spent fuel

disposal, regulatory and financial risks and the risk of terrorist attack.

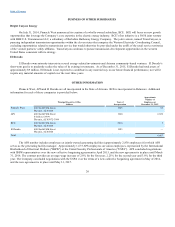

APS has an ownership interest in and operates, on behalf of a group of participants, Palo Verde, which is the largest nuclear

electric generating facility in the United States. Palo Verde constitutes approximately 19% of our owned and leased generation

capacity. Palo Verde is subject to environmental, health and financial risks, such as the ability to obtain adequate supplies of nuclear

fuel; the ability to dispose of spent nuclear fuel; the ability to maintain adequate reserves for decommissioning; potential liabilities

arising out of the operation of these facilities; the costs of securing the facilities against possible terrorist attacks; and unscheduled

outages due to equipment and other problems. APS maintains nuclear decommissioning trust funds and external insurance coverage to

minimize its financial exposure to some of these risks; however, it is possible that damages could exceed the amount of insurance

coverage. In addition, APS may be required under federal law to pay up to $111 million (but not more than $16.6 million per year) of

liabilities arising out of a nuclear incident occurring not only at Palo Verde, but at any other nuclear power plant in the United States.

Although we have no reason to anticipate a serious nuclear incident at Palo Verde, if an incident did occur, it could materially and

adversely affect our results of operations and financial condition. A major incident at a nuclear facility anywhere in the world could

cause the NRC to limit or prohibit the operation or licensing of any domestic nuclear unit and to promulgate new regulations that could

require significant capital expenditures and/or increase operating costs.

The use of derivative contracts in the normal course of our business could result in financial losses that negatively impact our results

of operations.

APS’s operations include managing market risks related to commodity prices. APS is exposed to the impact of market

fluctuations in the price and transportation costs of electricity, natural gas and coal to the extent that unhedged positions exist. We have

established procedures to manage risks associated with these market fluctuations by utilizing various commodity derivatives, including

exchange traded futures and options and over-the-counter forwards, options, and swaps. As part of our overall risk management

program, we enter into derivative transactions to hedge purchases and sales of electricity and fuels. The changes in market value of

such contracts have a high correlation to price changes in the hedged commodity. To the extent that commodity markets are illiquid,

we may not be able to execute our risk management strategies, which could result in greater unhedged positions than we would prefer

at a given time and financial losses that negatively impact our results of operations.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) contains measures aimed at increasing

the transparency and stability of the over-the counter, or OTC, derivative markets and preventing excessive speculation. The Dodd-

Frank Act could restrict, among other things, trading positions in the energy futures markets, require different collateral or settlement

positions, or increase regulatory reporting over derivative positions. Based on the provisions included in the Dodd-Frank Act and the

implementation of regulations, these changes could, among other things, impact our ability to hedge commodity price and interest rate

risk or increase the costs associated with our hedging programs.

34