APS 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

scale renewable technologies located on customers’ properties). The distributed energy requirement was 25% of the overall RES

requirement of 3% in 2011 and increased to 30% of the applicable RES requirement for 2012 and subsequent years. Customer

participation in distributed energy programs would result in lower demand, since customers would be meeting some or all of their own

energy needs. Reduced demand due to these energy efficiency and distributed energy requirements, unless substantially offset through

ratemaking mechanisms, could have a material adverse impact on APS’s financial condition, results of operations and cash flows.

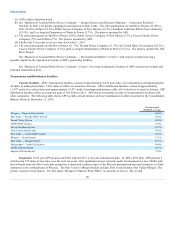

Customer and Sales Growth. For the three years 2013 through 2015, APS’s retail customer growth averaged 1.3% per year.

We currently expect annual customer growth to average in the range of 2.0-3.0% for 2016 through 2018 based on our assessment of

modestly improving economic conditions in Arizona. For the three years 2013 through 2015 APS experienced annual increases in

retail electricity sales averaging 0.1%, adjusted to exclude the effects of weather variations. We currently estimate that annual retail

electricity sales in kWh will increase on average in the range of 0.5-1.5% during 2016 through 2018, including the effects of customer

conservation and energy efficiency and distributed renewable generation initiatives, but excluding the effects of weather variations.

Actual customer and sales growth may differ from our projections as a result of numerous factors, such as economic conditions,

customer growth, usage patterns and energy conservation, impacts of energy efficiency programs and growth in distributed generation,

and responses to retail price changes. Additionally, recovery of a substantial portion of our fixed costs of providing service is based

upon the volumetric amount of our sales. If our customer growth rate does not continue to improve as projected, or if it declines, or if

the Arizona economy fails to improve, we may be unable to reach our estimated demand level and sales projections, which could have

a negative impact on our financial condition, results of operations and cash flows.

The operation of power generation facilities and transmission systems involves risks that could result in reduced output or

unscheduled outages, which could materially affect APS’s results of operations.

The operation of power generation, transmission and distribution facilities involves certain risks, including the risk of

breakdown or failure of equipment, fuel interruption, and performance below expected levels of output or efficiency. Unscheduled

outages, including extensions of scheduled outages due to mechanical failures or other complications, occur from time to time and are

an inherent risk of APS’s business. Because our transmission facilities are interconnected with those of third parties, the operation of

our facilities could be adversely affected by unexpected or uncontrollable events occurring on the larger transmission power grid, and

the operation or failure of our facilities could adversely affect the operations of others. If APS’s facilities operate below expectations,

especially during its peak seasons, it may lose revenue or incur additional expenses, including increased purchased power expenses.

Concerns over physical security of these assets is also increasing, which may require us to incur additional capital and operating costs

to address. Damage to certain of our facilities due to vandalism or other deliberate acts could lead to outages or other adverse effects.

The inability to successfully develop or acquire generation resources to meet reliability requirements, new or evolving standards or

regulations could adversely impact our business.

Potential changes in regulatory standards, impacts of new and existing laws and regulations, including environmental laws and

regulations, and the need to obtain certain regulatory approvals create uncertainty surrounding our generation portfolio. The current

abundance of low, stably priced natural gas, together with environmental and other concerns surrounding coal-fired generation

resources, create strategic questions related to the appropriate generation portfolio and fuel diversification mix. In addition, APS is

required by the ACC to meet certain energy resource portfolio requirements such as the EES and the RES. The development of any

generation facility is subject to many risks, including risks related to financing, siting, permitting, technology, the construction of

sufficient transmission capacity to support these facilities and stresses to generation and transmission resources from intermittent

generation characteristics of renewable resources.

32