APS 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

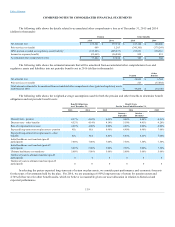

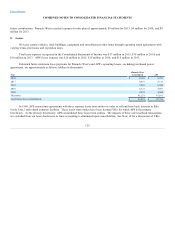

provide for a specific mix of long-term fixed income assets, but does expect the average credit quality of such assets to be investment

grade. As of December 31, 2015, long-term fixed income assets represented 60% of total pension plan assets, and return-generating

assets represented 40% of total pension plan assets.

As of December 31, 2015, the asset allocation for other postretirement benefit plan assets is governed by the IPS for those plans,

which provides for different asset allocation target mixes depending on the characteristics of the liability. Some of these asset allocation

target mixes vary with the plan’s funded status. As of December 31, 2015, investment in fixed income assets represented 40% of the

other postretirement benefit plan total assets, and non-fixed income assets represented 60% of the other postretirement benefit plan’s

assets. Fixed income assets are primarily invested in corporate bonds of investment-grade U.S. issuers, and U.S. Treasuries. Non-fixed

income assets are primarily invested in large cap U.S. equities in diverse industries, and international equities in both emerging and

developed markets.

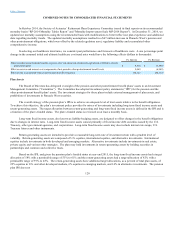

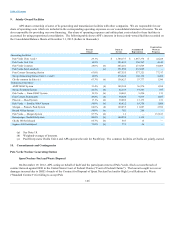

See Note 13 for a discussion on the fair value hierarchy and how fair value methodologies are applied. The plans invest directly

in fixed income and equity securities, in addition to investing indirectly in fixed income securities, equity securities and real estate

through the use of mutual funds, partnerships and common and collective trusts. Equity securities held directly by the plans are valued

using quoted active market prices from the published exchange on which the equity security trades, and are classified as Level 1. Fixed

income securities issued by the U.S. Treasury held directly by the plans are valued using quoted active market prices, and are classified

as Level 1. Fixed income securities issued by corporations, municipalities, and other agencies are primarily valued using quoted

inactive market prices, or quoted active market prices for similar securities, or by utilizing calculations which incorporate observable

inputs such as yield, maturity and credit quality. These instruments are classified as Level 2.

Mutual funds, partnerships, and common and collective trusts are valued utilizing a net asset value (NAV) concept or its

equivalent. Exchange traded mutual funds, are classified as Level 1, as the valuation for these instruments is based on the active market

in which the fund trades.

Common and collective trusts, are maintained by banks or investment companies and hold certain investments in accordance

with a stated set of objectives (such as tracking the performance of the S&P 500 Index). The trust's shares are offered to a limited group

of investors, and are not traded in an active market. The NAV for trusts investing in exchange traded equities is derived from the quoted

active market prices of the underlying securities held by the trusts. The NAV for trusts investing in real estate is derived from the

appraised values of the trust's underlying real estate assets. As of December 31, 2015, the plans were able to transact in the common

and collective trusts at NAV and classifies these investments as Level 2.

Investments in partnerships are also valued using the concept of NAV, which is derived from the value of the partnerships'

underlying assets. The plan's partnerships holdings relate to investments in high-yield fixed income instruments and assets of privately

held portfolio companies. Certain partnerships also include funding commitments that may require the plan to contribute up to $75

million to these partnerships; as of December 31, 2015, approximately $40 million of these commitments have been funded.

Partnerships are classified as Level 2 if the plan is able to transact in the partnership at the NAV, otherwise the partnership is classified

as Level 3.

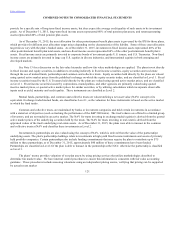

The plans’ trustee provides valuation of our plan assets by using pricing services that utilize methodologies described to

determine fair market value. We have internal control procedures to ensure this information is consistent with fair value accounting

guidance. These procedures include assessing valuations using an independent pricing source, verifying that pricing can be supported

by actual recent market

121