APS 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

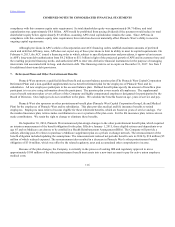

Cholla

On September 11, 2014, APS announced that it would close Cholla Unit 2 and cease burning coal at the other APS-owned units

(Units 1 and 3) at the plant by the mid-2020s, if EPA approves a compromise proposal offered by APS to meet required environmental

and emissions standards and rules. On April 14, 2015, the ACC approved APS's plan to retire Unit 2, without expressing any view on

the future recoverability of APS's remaining investment in the Unit. APS closed Unit 2 on October 1, 2015. Previously, APS estimated

Cholla Unit 2’s end of life to be 2033. APS is currently recovering a return on and of the net book value of the unit in base rates and

plans to seek recovery of the unit’s decommissioning and other retirement-related costs over the remaining life of the plant in its next

retail rate case. APS believes it will be allowed recovery of the remaining net book value of Unit 2 ($122 million as of December 31,

2015), in addition to a return on its investment. In accordance with GAAP, in the third quarter of 2014, Unit 2’s remaining net book

value was reclassified from property, plant and equipment to a regulatory asset. If the ACC does not allow full recovery of the

remaining net book value of Cholla Unit 2, all or a portion of the regulatory asset will be written off and APS’s net income, cash flows,

and financial position will be negatively impacted.

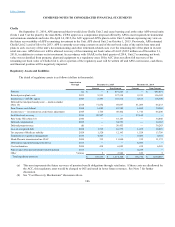

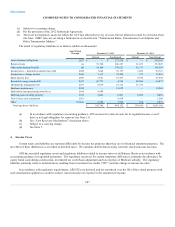

Regulatory Assets and Liabilities

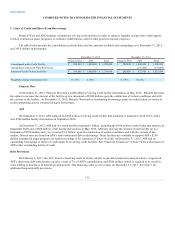

The detail of regulatory assets is as follows (dollars in thousands):

Amortization

Through

December 31, 2015

December 31, 2014

Current

Non-Current

Current

Non-Current

Pension (a)

$ —

$ 619,223

$ —

$ 485,037

Retired power plant costs 2033

9,913

127,518

9,913

136,182

Income taxes - AFUDC equity 2045

5,495

133,712

4,813

118,396

Deferred fuel and purchased power — mark-to-market

(Note 16) 2018

71,852

69,697

51,209

46,233

Four Corners cost deferral 2024

6,689

63,582

6,689

70,565

Income taxes — investment tax credit basis adjustment 2045

1,766

48,462

1,716

46,200

Lost fixed cost recovery 2016

45,507

—

37,612

—

Palo Verde VIEs (Note 18) 2046

—

18,143

—

34,440

Deferred compensation 2036

—

34,751

—

34,162

Deferred property taxes (d)

—

50,453

—

30,283

Loss on reacquired debt 2034

1,515

16,375

1,435

16,410

Tax expense of Medicare subsidy 2024

1,520

12,163

1,528

13,756

Transmission vegetation management 2016

4,543

—

9,086

4,543

Mead-Phoenix transmission line CIAC 2050

332

11,040

332

11,372

Deferred fuel and purchased power (b) (c) 2015

—

—

6,926

—

Coal reclamation 2026

418

6,085

418

6,503

Pension and other postretirement benefits deferral 2015

—

—

4,238

—

Other Various

5

2,942

819

5

Total regulatory assets (e)

$ 149,555

$ 1,214,146

$ 136,734

$ 1,054,087

(a) This asset represents the future recovery of pension benefit obligations through retail rates. If these costs are disallowed by

the ACC, this regulatory asset would be charged to OCI and result in lower future revenues. See Note 7 for further

discussion.

(b) See “Cost Recovery Mechanisms” discussion above.

106