APS 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

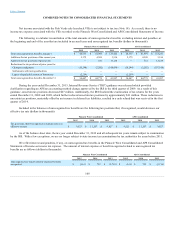

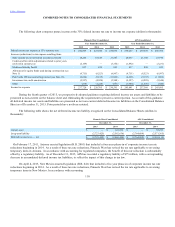

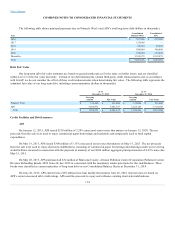

On November 6, 2015, APS issued $250 million of 4.35% unsecured senior notes that mature on November 15, 2045. The net

proceeds from the sale were used to refinance via redemption and cancellation at par our indebtedness related to the principal amounts

of the Navajo County, Arizona Pollution Control Corporation Pollution Control Revenue Refunding Bonds (Arizona Public Service

Company Cholla Project), 2009 Series A and 2009 Series C both due June 1, 2034, and repay commercial paper borrowings and

replenish cash temporarily used to fund capital expenditures.

On November 17, 2015, APS redeemed at par and canceled all $38 million of the Navajo County, Arizona Pollution Control

Corporation Revenue Refunding Bonds (Arizona Public Service Company Cholla Project), 2009 Series A. These bonds were classified

as current maturities of long-term debt on our Consolidated Balance Sheets at December 31, 2014.

On November 17, 2015, APS canceled all $32 million of the Navajo County, Arizona Pollution Control Corporation Revenue

Refunding Bonds (Arizona Public Service Company Cholla Project), 2009 Series B, purchased in connection with the mandatory tender

provision on May 30, 2014.

On December 8, 2015, APS redeemed at par and canceled all $32 million of the Navajo County, Arizona Pollution Control

Corporation Revenue Refunding Bonds (Arizona Public Service Company Cholla Project), 2009 Series C.

See “Lines of Credit and Short-Term Borrowings” in Note 5 and “Financial Assurances” in Note 10 for discussion of APS’s

separate outstanding letters of credit.

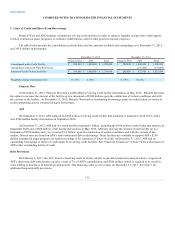

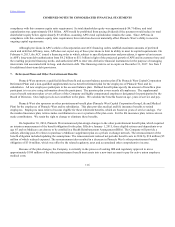

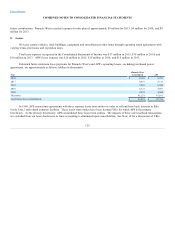

Debt Provisions

Pinnacle West’s and APS’s debt covenants related to their respective bank financing arrangements include maximum debt to

capitalization ratios. Pinnacle West and APS comply with this covenant. For both Pinnacle West and APS, this covenant requires that

the ratio of consolidated debt to total consolidated capitalization not exceed 65%. At December 31, 2015, the ratio was approximately

47% for Pinnacle West and 46% for APS. Failure to comply with such covenant levels would result in an event of default which,

generally speaking, would require the immediate repayment of the debt subject to the covenants and could cross-default other debt.

See further discussion of “cross-default” provisions below.

Neither Pinnacle West’s nor APS’s financing agreements contain “rating triggers” that would result in an acceleration of the

required interest and principal payments in the event of a rating downgrade. However, our bank credit agreements contain a pricing

grid in which the interest rates we pay for borrowings thereunder are determined by our current credit ratings.

All of Pinnacle West’s loan agreements contain “cross-default” provisions that would result in defaults and the potential

acceleration of payment under these loan agreements if Pinnacle West or APS were to default under certain other material agreements.

All of APS’s bank agreements contain "cross-default" provisions that would result in defaults and the potential acceleration of payment

under these bank agreements if APS were to default under certain other material agreements. Pinnacle West and APS do not have a

material adverse change restriction for credit facility borrowings.

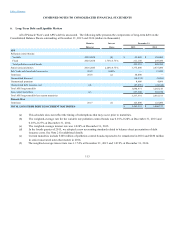

An existing ACC order requires APS to maintain a common equity ratio of at least 40%. As defined in the ACC order, the

common equity ratio is total shareholder equity divided by the sum of total shareholder equity and long-term debt, including current

maturities of long-term debt. At December 31, 2015, APS was in

115