APS 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

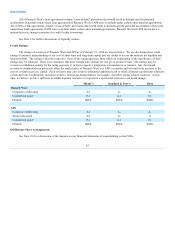

Operations and maintenance. Operations and maintenance expenses decreased $17 million for the year ended December 31,

2014 compared with the prior year primarily because of:

• A decrease of $33 million related to costs for demand-side management, renewable energy and similar regulatory

programs, which were partially offset in operating revenues and purchased power;

• A decrease of $20 million related to lower employee benefit costs;

• An increase of $33 million in generation costs, primarily related to an increased ownership share in Four Corners, a

portion of which is deferred in depreciation and amortization, and higher fossil maintenance costs; and

• An increase of $3 million related to miscellaneous other factors.

Depreciation and amortization. Depreciation and amortization expenses were $1 million higher for the year ended

December 31, 2014 compared with the prior year primarily related to higher plant balances of approximately $23 million, partially

offset by higher Four Corners cost deferrals in the current year of approximately $22 million.

Taxes other than income taxes. Taxes other than income taxes were $8 million higher for the year ended December 31, 2014

compared with the prior year primarily due to higher property tax rates and higher plant balances.

All other income and expenses, net. All other income and expenses, net, were $17 million higher for the year ended

December 31, 2014 compared with the prior year due to the debt return on the Four Corners acquisition, an increase in the allowance

for equity funds used during construction due to higher balances, and other non-operating income.

Income taxes. Income taxes were $8 million lower for the year ended December 31, 2014 compared with the prior year

primarily due to the effects of lower pretax income in the current year.

LIQUIDITY AND CAPITAL RESOURCES

Overview

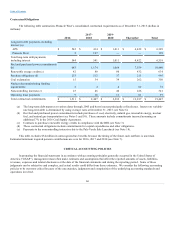

Pinnacle West’s primary cash needs are for dividends to our shareholders and principal and interest payments on our

indebtedness. The level of our common stock dividends and future dividend growth will be dependent on declaration by our Board of

Directors and based on a number of factors, including our financial condition, payout ratio, free cash flow and other factors.

Our primary sources of cash are dividends from APS and external debt and equity issuances. An ACC order requires APS to

maintain a common equity ratio of at least 40%. As defined in the related ACC order, the common equity ratio is defined as total

shareholder equity divided by the sum of total shareholder equity and long-term debt, including current maturities of long-term debt.

At December 31, 2015, APS’s common equity ratio, as defined, was 55%. Its total shareholder equity was approximately $4.7 billion,

and total capitalization was approximately $8.6 billion. Under this order, APS would be prohibited from paying dividends if such

payment would reduce its total shareholder equity below approximately $3.4 billion, assuming APS’s total capitalization remains the

same. This restriction does not materially affect Pinnacle West’s ability to meet its ongoing cash needs or ability to pay dividends to

shareholders.

59