APS 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

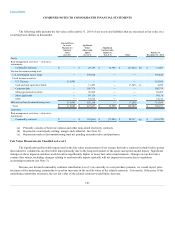

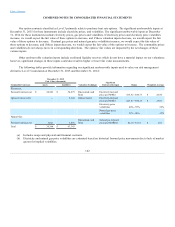

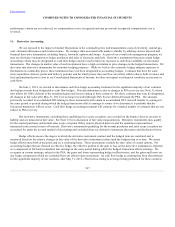

Selected Quarterly Financial Data (Unaudited) - APS

APS's quarterly financial information for 2015 and 2014 is as follows (dollars in thousands):

2015 Quarter Ended,

2015

March 31,

June 30,

September 30,

December 31,

Total

Operating revenues $ 670,668

$ 889,723

$ 1,198,380

$ 733,586

$ 3,492,357

Operations and maintenance 209,947

208,031

216,011

219,146

853,135

Operating income 61,333

162,704

301,238

86,709

611,984

Net income attributable to common shareholder 19,868

125,362

261,187

43,857

450,274

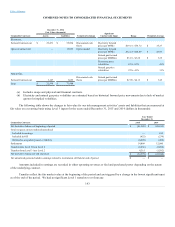

2014 Quarter Ended,

2014

March 31,

June 30,

September 30,

December 31,

Total

Operating revenues $ 685,545

$ 905,578

$ 1,172,190

$ 725,633

$ 3,488,946

Operations and maintenance 208,285

208,059

212,430

253,668

882,442

Operating income 69,635

180,394

287,928

54,835

592,792

Net income attributable to common shareholder 19,518

134,916

251,047

15,738

421,219

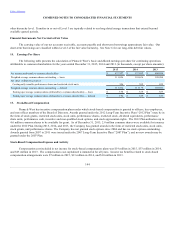

13. Fair Value Measurements

We classify our assets and liabilities that are carried at fair value within the fair value hierarchy. This hierarchy ranks the quality

and reliability of the inputs used to determine fair values, which are then classified and disclosed in one of three categories. The three

levels of the fair value hierarchy are:

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that we have the ability to access at the

measurement date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to

provide information on an ongoing basis. This category includes exchange traded equities, exchange traded derivative instruments,

exchange traded mutual funds, cash equivalents, and investments in U.S. Treasury securities.

Level 2 — Utilizes quoted prices in active markets for similar assets or liabilities; quoted prices in markets that are not active;

and model-derived valuations whose inputs are observable (such as yield curves). This category includes non-exchange traded

contracts such as forwards, options, swaps and certain investments in fixed income securities. This category also includes certain

investments that are valued and redeemable based on NAV, such as common and collective trusts and commingled funds.

Level 3 — Valuation models with significant unobservable inputs that are supported by little or no market activity. Instruments

in this category include long-dated derivative transactions where valuations are unobservable due to the length of the transaction,

options, and transactions in locations where observable market data does not exist. The valuation models we employ utilize spot prices,

forward prices, historical market data and other factors to forecast future prices.

Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value

measurement. Thus, a valuation may be classified in Level 3 even though the valuation may include significant inputs that are readily

observable. We maximize the use of observable inputs and minimize the use of unobservable inputs. We rely primarily on the market

approach of using prices and other market

137