APS 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

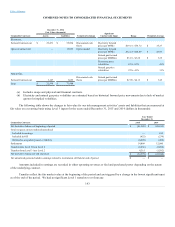

long-term nature of our energy transactions and the use of option valuation models with significant unobservable inputs.

Our energy risk management committee, consisting of officers and key management personnel, oversees our energy risk

management activities to ensure compliance with our stated energy risk management policies. We have a risk control function that is

responsible for valuing our derivative commodity instruments in accordance with established policies and procedures. The risk control

function reports to the chief financial officer’s organization.

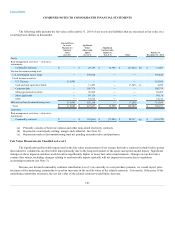

Investments Held in our Nuclear Decommissioning Trust

The nuclear decommissioning trust invests in fixed income securities and equity securities. Equity securities are held indirectly

through commingled funds. The commingled funds are valued based on the concept of NAV, which is a value primarily derived from

the quoted active market prices of the underlying equity securities. We may transact in these commingled funds on a semi-monthly

basis at the NAV. We classify these investments as Level 2. The commingled funds are maintained by a bank and hold investments in

accordance with the stated objective of tracking the performance of the S&P 500 Index. Because the commingled fund shares are

offered to a limited group of investors, they are not considered to be traded in an active market.

Cash equivalents reported within Level 1 represent investments held in a short-term investment exchange-traded mutual fund,

which invests in certificates of deposit, variable rate notes, time deposit accounts, U.S. Treasury and Agency obligations, U.S. Treasury

repurchase agreements, and commercial paper.

Fixed income securities issued by the U.S. Treasury held directly by the nuclear decommissioning trust are valued using quoted

active market prices and are typically classified as Level 1. Fixed income securities issued by corporations, municipalities, and other

agencies, including mortgage-backed instruments, are valued using quoted inactive market prices, quoted active market prices for

similar securities, or by utilizing calculations which incorporate observable inputs such as yield curves and spreads relative to such

yield curves. These instruments are classified as Level 2. Whenever possible, multiple market quotes are obtained which enables a

cross-check validation. A primary price source is identified based on asset type, class, or issue of securities.

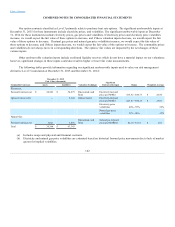

We price securities using information provided by our trustee for our nuclear decommissioning trust assets. Our trustee uses

pricing services that utilize the valuation methodologies described to determine fair market value. We have internal control procedures

designed to ensure this information is consistent with fair value accounting guidance. These procedures include assessing valuations

using an independent pricing source, verifying that pricing can be supported by actual recent market transactions, assessing hierarchy

classifications, comparing investment returns with benchmarks, and obtaining and reviewing independent audit reports on the trustee’s

internal operating controls and valuation processes. See Note 19 for additional discussion about our nuclear decommissioning trust.

139