APS 2015 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

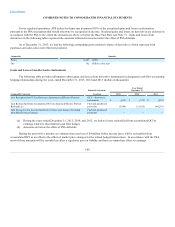

Restricted Stock Units, Stock Grants, and Stock Units

Restricted stock units have been granted to officers and key employees. Restricted stock units typically vest and settle in equal

annual installments over a 4-year period after the grant date. Vesting is typically dependent upon continuous service during the vesting

period; however, awards granted to retirement-eligible employees will vest upon the employee's retirement. Awardees elect to receive

payment in either 100% stock, or 50% in cash and 50% in stock. Restricted stock unit awards typically include a dividend equivalent

feature. This feature allows each award to accrue dividend rights, equal to the amount of dividends that they would have received had

they directly owned stock, equal to the number of vested restricted stock units from the date of grant to the date of payment plus interest

compounded quarterly. If the award is forfeited the employee is not entitled to the dividends on those shares.

In December 2012, a retention award of 50,617 restricted stock units was granted to the Chairman of the Board, President, and

Chief Executive Officer of Pinnacle West. This award will vest and will be paid in shares of common stock on December 31, 2016,

provided that he remains employed with the Company until the vesting date. The award can be increased up to an additional 33,745

restricted stock units payable in stock if certain performance requirements are met.

Restricted stock unit awards are accounted for as liability awards, with compensation cost initially calculated on the date of

grant using the Company’s closing stock price, and remeasured at each balance sheet date.

Stock grants are issued to non-officer members of the Board of Directors. They may elect to receive the stock grant, or to defer

receipt until a later date and receive stock units in lieu of the stock grant. The members of the Board of Directors who elect to defer

may elect to receive payment in either 100% stock, or 50% in cash and 50% in stock. The stock units accrue dividend rights, equal to

the amount of dividends the Directors would have received had they directly owned stock equal to the number of vested restricted stock

units or stock units from the date of grant to the date of payment plus interest compounded quarterly. The dividends and interest are

paid, based on the Director’s election, in either stock, or 50% in cash and 50% in stock.

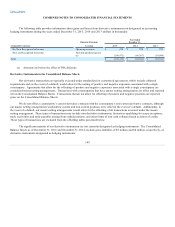

Performance Share Awards

Performance share awards have been granted to officers and key employees. Performance share awards contain two

performance element criteria that affect the number of shares received after the end of a three-year performance period if performance

criteria conditions are met. The performance share grant criteria is based 50% upon the percentile ranking of Pinnacle West’s total

shareholder return at the end of the three-year performance period, as compared with the total shareholder return of all relevant

companies in a specified utility index and the other 50% is based upon six non-financial separate performance metrics. The exact

number of shares issued will vary from 0% to 200% of the target award. Shares received include dividend rights paid in stock equal to

the amount of dividends that they would have received had they directly owned stock, equal to the number of vested performance

shares from the date of grant to the date of payment plus interest compounded quarterly. If the award is forfeited or if the performance

criteria are not achieved the employee is not entitled to the dividends on those shares.

Performance share awards are accounted for as liability awards, with compensation cost initially calculated on the date of grant

using the Company’s closing stock price, and remeasured at each balance sheet date. Management evaluates the probability of meeting

the performance criteria at each balance sheet date. If

146