APS 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

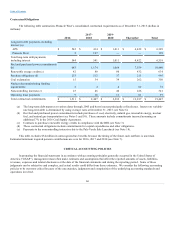

Capital expenditures will be funded with internally generated cash and external financings, which may include issuances of

long-term debt and Pinnacle West common stock.

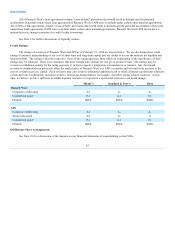

Financing Cash Flows and Liquidity

2015 Compared with 2014. Pinnacle West’s consolidated net cash provided by financing activities was $4 million in 2015,

compared to $179 million net cash used in 2014, an increase of $183 million in net cash provided. The increase in net cash provided

by financing activities is primarily due to $237 million lower repayments of long-term debt and $111 million higher issuances of long-

term debt (see below), partially offset by a $142 million net change in short-term borrowings.

2014 Compared with 2013. Pinnacle West’s consolidated net cash used for financing activities was $179 million in 2014,

compared to $161 million in 2013, an increase of $18 million in net cash used. The increase in net cash used for financing activities is

primarily due to $530 million in higher repayments of long-term debt, a $67 million net reduction in funds received through short-term

borrowings, and $11 million in higher dividend payments, partially offset by $595 million in higher issuances of long-term debt (see

below).

Significant Financing Activities. On December 16, 2015, the Pinnacle West Board of Directors declared a quarterly dividend of

$0.625 per share of common stock, payable on March 1, 2016, to shareholders of record on February 1, 2015. During 2015, Pinnacle

West increased its indicated annual dividend from $2.38 per share to $2.50 per share. For the year ended December 31, 2015, Pinnacle

West’s total dividends paid per share of common stock were $2.41 per share, which resulted in dividend payments of $260 million.

On January 12, 2015, APS issued $250 million of 2.20% unsecured senior notes that mature on January 15, 2020. The net

proceeds from the sale were used to repay commercial paper borrowings and replenish cash temporarily used to fund capital

expenditures.

On May 19, 2015, APS issued $300 million of 3.15% unsecured senior notes that mature on May 15, 2025. The net proceeds

from the sale were used to repay short-term indebtedness consisting of commercial paper borrowings and drawings under our revolving

credit facilities, incurred in connection with the payment at maturity of our $300 million aggregate principal amount of 4.65% notes due

May 15, 2015.

On May 28, 2015, APS purchased all $32 million of Maricopa County, Arizona Pollution Control Corporation Pollution Control

Revenue Refunding Bonds, 2009 Series B, due 2029 in connection with the mandatory tender provisions for this indebtedness. These

bonds were classified as current maturities of long-term debt on our Consolidated Balance Sheets at December 31, 2014.

On June 26, 2015, APS entered into a $50 million term loan facility that matures June 26, 2018. Interest rates are based on

APS’s senior unsecured debt credit ratings. APS used the proceeds to repay and refinance existing short-term indebtedness.

On November 6, 2015, APS issued $250 million of 4.35% unsecured senior notes that mature on November 15, 2045. The net

proceeds from the sale were used to refinance via redemption and cancellation at par our indebtedness related to the principal amounts

of the Navajo County, Arizona Pollution Control Corporation Pollution Control Revenue Refunding Bonds (Arizona Public Service

Company Cholla Project), 2009 Series A and 2009 Series C both due June 1, 2034, and repay commercial paper borrowings and

replenish cash temporarily used to fund capital expenditures.

On November 17, 2015, APS redeemed at par and canceled all $38 million of the Navajo County, Arizona Pollution Control

Corporation Revenue Refunding Bonds (Arizona Public Service Company Cholla

63