APS 2015 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2015 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

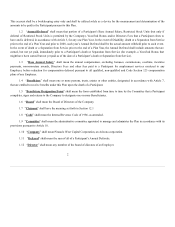

DEFERRED COMPENSATION PLAN OF 2005 FOR

EMPLOYEES OF PINNACLE WEST CAPITAL CORPORATION AND AFFILIATES

Effective January 1, 1992, Pinnacle West Capital Corporation, an Arizona corporation (the “Company”), established the

Pinnacle West Capital Corporation, Arizona Public Service Company, SunCor Development Company and El Dorado Investment

Company Deferred Compensation Plan (the “Prior Plan”). Effective December 31, 2004, the Company restated the Prior Plan in its

entirety to incorporate all prior amendments to the Prior Plan as in effect on October 3, 2004, and to cease future deferrals thereunder

after December 31, 2004. Effective January 1 , 2005, the Company established a new deferred compensation plan that was

substantially similar to the Prior Plan, except to the extent required by Section 409A of the Internal Revenue Code of 1986, as

amended, and was known a s the Deferred Compensation Plan o f 2005 for Employees o f Pinnacle West Capital Corporation and

Affiliates (“2005 Plan”) for the purpose of providing specified benefits to a select group of management, highly compensated

employees and Directors who contribute materially to the continued growth, development and future business success of the Company,

Arizona Public Service Company, Suncor Development Company, El Dorado Investment Company, and their subsidiaries. The 2005

Plan applied to deferred compensation which was either earned or first became vested after December 31, 2004, applying the rules set

forth in Treasury Regulation Section 1.409A-6. As a result, the 2005 Plan applied to any interest credits above the Base Rate (as

defined in the 2005 Plan) with respect to the December 31, 2004 Account Balance of any Participant who had less than five years of

Plan Participation as of December 31, 2004. Otherwise, the 2005 Plan did not apply to an individual’s December 31, 2004 Account

Balance and any interest credited to such Account Balance.

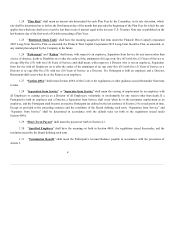

By this instrument the Company intends to amend and restate the 2005 Plan in its entirety to make certain modifications the

Company deems appropriate (the “Plan”). This amended and restated Plan is effective on January 1, 2016 (the “Effective Date”) and

only applies to Participants who incur a Separation form Service on or after the Effective Date. The plan document as in effect on the

date of the Participant’s Separation from Service will apply to Participants who terminate employment prior to the Effective Date.

ARTICLE 1

Definitions

Unless otherwise clearly apparent from the context, the following phrases or terms shall have the following indicated meanings

for purposes of the Plan:

1.1 “Account Balance” shall mean the sum of (i) the Deferral Amount and (ii) interest credited in accordance with all the

applicable interest crediting provisions of the Plan, reduced by all Short-Term Payouts and other distributions, i f any. The term

“Account Balance” does not include any Discretionary Credits allocated to the Participant in accordance with Section 3.9.