Starbucks 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

expense and income taxes. Management does not evaluate the performance of its operating segments using asset

measures. The identifiable assets by segment disclosed in this note are those assets specifically identifiable within

each segment and include net property, plant and equipment, equity and cost investments, goodwill, and other

intangible assets. Corporate assets are primarily comprised of cash and investments, assets of the corporate

headquarters and roasting facilities, and inventory.

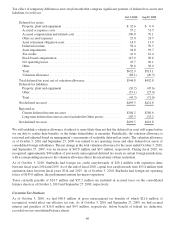

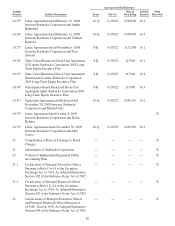

The table below presents information by operating segment for the fiscal years noted (in millions):

United States International CPG Other Total

Fiscal 2010:

Totalnetrevenues ........................ $7,560.4 $2,288.8 $707.4 $ 150.8 $10,707.4

Depreciationandamortization ............... 350.7 108.6 3.7 47.4 510.4

Income(loss)fromequityinvestees........... 0.0 80.8 70.6 (3.3) 148.1

Operating income/(loss) .................... 1,291.1 225.2 261.4 (358.3) 1,419.4

Total assets ............................. 1,482.9 1,272.8 54.1 3,576.1 6,385.9

Fiscal 2009:

Totalnetrevenues ........................ $7,061.7 $1,914.3 $674.4 $ 124.2 $ 9,774.6

Depreciationandamortization ............... 377.9 102.2 4.8 49.8 534.7

Incomefromequityinvestees ............... 0.5 53.6 67.8 0.0 121.9

Operating income/(loss) .................... 530.1 91.2 281.8 (341.1) 562.0

Total assets ............................. 1,640.8 1,071.3 71.1 2,793.6 5,576.8

Fiscal 2008:

Totalnetrevenues ........................ $7,491.2 $2,099.6 $680.9 $ 111.3 $10,383.0

Depreciationandamortization ............... 395.1 108.6 5.4 40.2 549.3

Income(loss)fromequityinvestees........... (1.3) 54.2 60.7 0.0 113.6

Operating income/(loss) .................... 454.0 108.8 269.9 (328.8) 503.9

Total assets ............................. 1,956.9 1,066.0 54.6 2,595.1 5,672.6

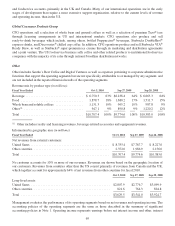

The table below reconciles the total of the reportable segments’ operating income to the consolidated earnings

before income taxes (in millions):

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Operatingincome ............................................ $1,419.4 $562.0 $503.9

Interestincomeandother,net ................................... 50.3 37.0 5.2

Interestexpense .............................................. (32.7) (39.1) (53.4)

Earningsbeforeincometaxes ................................... $1,437.0 $559.9 $455.7

Note 20: Subsequent Event

In the first quarter of fiscal 2011, Starbucks notified Kraft Foods Global, Inc. that we are discontinuing our licensing

relationships. Through these relationships with Kraft, Starbucks sells a selection of Starbucks and Seattle’s Best

Coffee branded packaged coffees and Tazo®teas in grocery and warehouse club stores throughout the US, and to

grocery stores in Canada, the UK and other European countries. Kraft manages the distribution, marketing,

advertising and promotion of these products. Discussions between Starbucks and Kraft are ongoing as of the date of

the filing of this 10-K and there is the possibility of a commercial dispute between the parties. At this time Starbucks

is unable to estimate the range of possible outcomes with respect to this matter.

70