Starbucks 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• we reclassified minority interests previously reported on our consolidated balance sheets as a component of

other long-term liabilities to noncontrolling interests and included it as a component of equity

In June 2009, the FASB issued authoritative guidance on the consolidation of variable interest entities (“VIE”),

which will be effective for our first fiscal quarter of 2011. The new guidance requires a qualitative approach to

identify a controlling financial interest in a VIE, and requires ongoing assessment of whether an entity is a VIE and

whether an interest in a VIE makes the holder the primary beneficiary of the VIE. We believe the adoption of this

new guidance will not have a material effect on our consolidated financial statements.

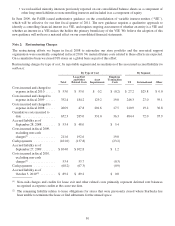

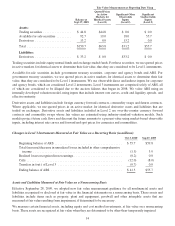

Note 2: Restructuring Charges

The restructuring efforts we began in fiscal 2008 to rationalize our store portfolio and the non-retail support

organization were essentially completed in fiscal 2010. No material future costs related to these efforts are expected.

On a cumulative basis we closed 918 stores on a global basis as part of this effort.

Restructuring charges by type of cost, by reportable segment and reconciliation of the associated accrued liability (in

millions):

By Type of Cost By Segment

Total

Lease Exit

and Other

Related Costs

Asset

Impairments

Employee

Termination

Costs US International Other

Costs incurred and charged to

expense in fiscal 2010 ...... $ 53.0 $ 53.0 $ 0.2 $ (0.2) $ 27.2 $25.8 $ 0.0

Costs incurred and charged to

expense in fiscal 2009 ...... 332.4 184.2 129.2 19.0 246.3 27.0 59.1

Costs incurred and charged to

expense in fiscal 2008 ...... 266.9 47.8 201.6 17.5 210.9 19.2 36.8

Cumulative costs incurred to

date .................... 652.3 285.0 331.0 36.3 484.4 72.0 95.9

Accrued liability as of

September 28, 2008 ........ $ 53.4 $ 48.0 $ 5.4

Costs incurred in fiscal 2009,

excluding non-cash

charges(1) ................ 211.6 192.6 19.0

Cashpayments ............. (161.0) (137.8) (23.2)

Accrued liability as of

September 27, 2009 ........ $104.0 $ 102.8 $ 1.2

Costs incurred in fiscal 2010,

excluding non-cash

charges(1) ................ 53.4 53.7 (0.3)

Cashpayments ............. (68.2) (67.3) (0.9)

Accrued liability as of

October 3, 2010(2) ......... $ 89.2 $ 89.2 $ 0.0

(1) Non-cash charges and credits for lease exit and other related costs primarily represent deferred rent balances

recognized as expense credits at the cease-use date.

(2) The remaining liability relates to lease obligations for stores that were previously closed where Starbucks has

been unable to terminate the lease or find subtenants for the unused space.

50