Starbucks 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

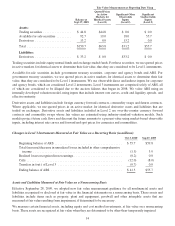

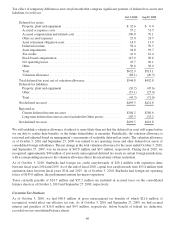

RSU transactions from September 30, 2007 through October 3, 2010 (in millions, except per share and contractual

life amounts):

Number

of

Shares

Weighted

Average

Grant Date

Fair Value

per Share

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

Nonvested,September30,2007................. 0.2 $27.83 3.0 $ 4.7

Granted ................................. 2.0 16.43

Vested .................................. 0.0 0.00

Forfeited/Cancelled ........................ (0.2) 17.27

Nonvested,September28,2008................. 2.0 17.36 2.5 30.5

Granted ................................. 3.3 8.78

Vested .................................. 0.0 0.00

Forfeited/Cancelled ........................ (0.9) 13.94

Nonvested,September27,2009................. 4.4 11.55 1.6 88.2

Granted ................................. 2.3 22.27

Vested .................................. (0.7) 16.35

Forfeited/Cancelled ........................ (0.6) 12.27

Nonvested, October 3, 2010 .................... 5.4 13.55 1.1 140.8

As of October 3, 2010, total unrecognized stock-based compensation expense related to nonvested RSUs, net of

estimated forfeitures, was approximately $44 million, before income taxes, and is expected to be recognized over a

weighted average period of approximately 2.0 years.

ESPP

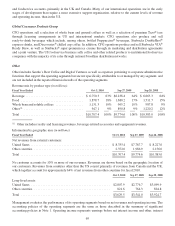

Our ESPP allows eligible employees to contribute up to 10% of their base earnings toward the quarterly purchase of

our common stock, subject to an annual maximum dollar amount. The purchase price is 95% of the fair market value

of the stock on the last business day of the quarterly offering period. The number of shares issued under our ESPP

was 0.8 million in fiscal 2010.

Deferred Stock Plan

We have a deferred stock plan for certain non-employees that enables participants in the plan to defer receipt of

ownership of common shares from the exercise of nonqualified stock options. The minimum deferral period is five

years. As of October 3, 2010 and September 27, 2009, 3.4 million shares were deferred under the terms of this plan.

The rights to receive these shares, represented by common stock units, are included in the calculation of basic and

diluted earnings per share as common stock equivalents. No new initial deferrals are permitted under this plan; the

plan permits re-deferrals of previously deferred shares.

Defined Contribution Plans

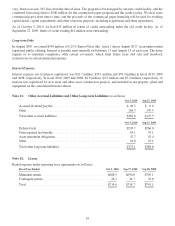

We maintain voluntary defined contribution plans, both qualified and non-qualified, covering eligible employees as

defined in the plan documents. Participating employees may elect to defer and contribute a portion of their eligible

compensation to the plans up to limits stated in the plan documents, not to exceed the dollar amounts set by

applicable laws.

Our matching contributions to all US and non-US plans were $23.5 million, $19.7 million and $25.3 million in fiscal

years 2010, 2009 and 2008, respectively.

64